Living abroad brings its own set of adventures and challenges, especially when it comes to navigating U.S. tax obligations. If you’re an expat with a financial footprint across borders, you’ll need to familiarize yourself with IRS Form 8938, a key component of the Foreign Account Tax Compliance Act (FATCA)

What is Form 8938?

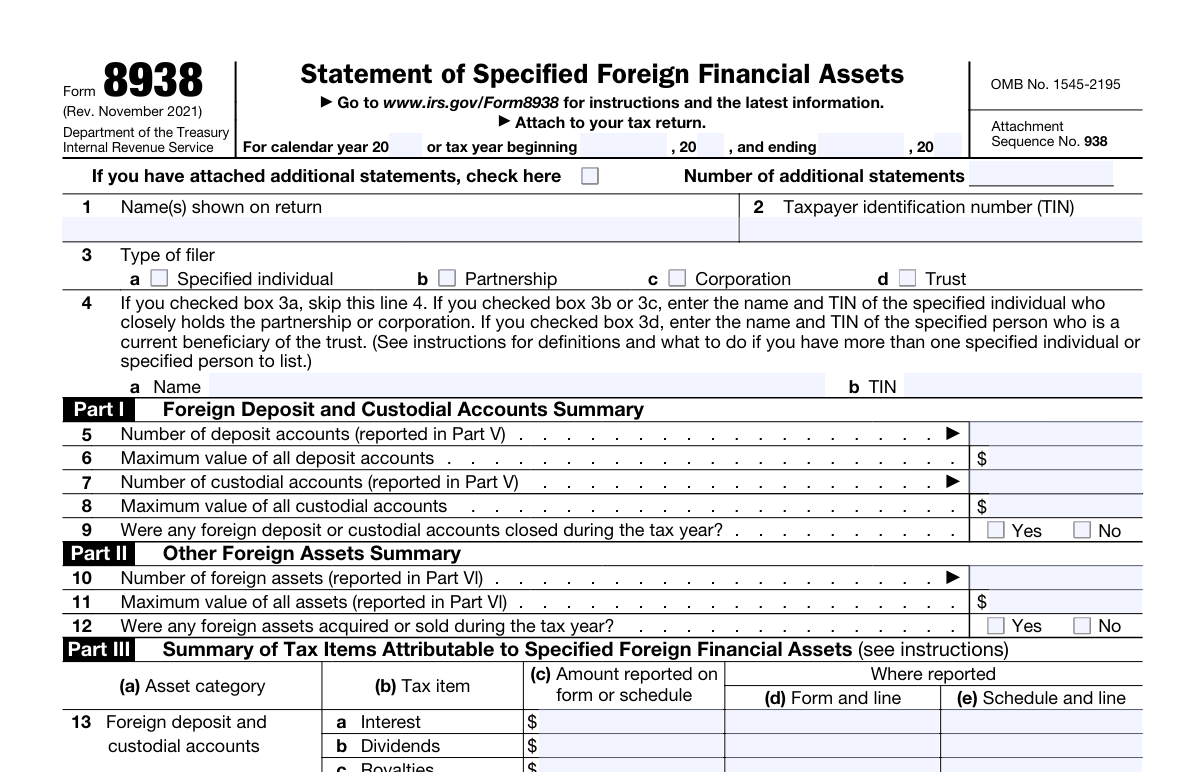

Form 8938, Statement of Specified Foreign Financial Assets, is used to report certain foreign financial assets required to be disclosed under FATCA. These include:

- Foreign bank and financial accounts

- Foreign issued life insurance policies with cash value

- Foreign securities and stocks not held in a financial account

- Interests in foreign entities, including partnerships, trusts, and estates

- Foreign pensions and annuity contracts

- Foreign branch accounts of U.S. financial institutions

- Specified domestic entities that hold foreign assets

The combined account balance or aggregate value of these assets determines your filing requirement.

Related: How to Determine the Maximum Value of an Account for FBAR

Who Must File Form 8938?

You must file Form 8938 if:

- You are a U.S. citizen, resident alien, or certain nonresident alien

- You are required to file an annual income tax return

- The total value of your specified foreign financial assets exceeds the following thresholds for the tax year:

U.S. Residents:

- Single / Married Filing Separately: Over $50,000 on the last day of the year or over $75,000 at any time

- Married Filing Jointly: Over $100,000 on the last day or over $150,000 at any time

Non-U.S. Residents (Expats):

- Single / Married Filing Separately: Over $200,000 on the last day or over $300,000 at any time

- Married Filing Jointly: Over $400,000 on the last day or over $600,000 at any time

Note: Foreign real estate owned outright and foreign currency held directly are not reportable. However, foreign real estate held through a foreign entity is reportable on Form 8938.

What Are Foreign Financial Assets?

Foreign accounts or financial assets refer to financial accounts and investments held outside the United States, often subject to reporting to the U.S. Internal Revenue Service by U.S. taxpayers. These assets can include, but are not limited to:

- Financial accounts maintained at foreign financial institutions, such as:

- Bank accounts (checking, savings, CDs, etc.)

- Brokerage and securities accounts

- Commodity futures or options accounts

- Insurance policies with cash value

- Annuity policies with cash value

- Shares in a foreign mutual fund

- Other foreign financial assets not held in a financial account, such as:

- Stocks or securities issued by a foreign person or entity

- Interests in a foreign partnership

- Interests in a foreign trust or estate

- Financial instruments or contracts with a foreign issuer or counterparty

- The “foreign” aspect refers to the assets being physically located or issued outside of the United States.

- Foreign financial assets do not include foreign real estate, foreign currency, or financial accounts maintained at U.S. financial institutions, even if they hold foreign stocks/securities.

- The key criteria is that the financial asset is “foreign” in nature, meaning it is issued, held or maintained outside of the United States.

What is the difference between FBAR and Form 8938?

While FBAR and Form 8938 both involve the reporting of specified foreign financial asset information, they are distinct in their requirements, reporting thresholds, and the types of assets they cover.

Thresholds and Specified Persons:

- FBAR (FinCEN Form 114): Requires U.S. persons with a total of more than $10,000 in foreign financial accounts held at any point in the calendar year to report. “U.S. persons” include citizens, residents, corporations, partnerships, and trusts. It is important to note that having signature authority over a bank account does not qualify that account for FATCA reporting, emphasizing the distinction between ownership and mere signing authority.

- Form 8938: Targets a broader range of U.S. filers with higher reporting thresholds. Unmarried individuals must report if they have foreign assets worth more than $200,000 at the year’s end or $300,000 at any time during the year. Married individuals filing jointly have a threshold of $400,000 worth of foreign assets at the year’s end or $600,000 at any time during the year.

Reporting Requirements:

- FBAR: Focuses exclusively on foreign financial accounts, including bank accounts, brokerage accounts, and mutual funds.

- Form 8938: Requires reporting on a wider array of foreign financial assets, not just accounts. This includes foreign stocks not held in a financial account, interests in foreign entities, and foreign securities.

Filing Process:

- FBAR: Filed separately from the individual’s tax return, directly to the Financial Crimes Enforcement Network (FinCEN) using the BSA E-Filing System.

- Form 8938: Filed as part of an individual’s annual tax return to the IRS, making it directly tied to the tax filing process.

Understanding these differences is crucial for compliance with U.S. tax laws and avoiding potential penalties. Each form serves a specific purpose in the broader aim of preventing tax evasion and promoting financial transparency.

Related: FBAR vs Form 8938: A Side-by-Side Comparison

Exceptions to Filing

Not all foreign financial assets must be reported on Form 8938. Exceptions include assets held by specified domestic entities (like corporations and partnerships) and assets below the reporting threshold. If you’re not required to file a U.S. income tax return, you generally don’t need to file Form 8938.

However, those who must file should ensure full compliance to avoid civil or criminal penalties, including fines or imprisonment. If unsure, consult a tax professional to clarify your reporting obligations.

Penalties for Not Filing Form 8938

Penalties for failing to file Form 8938 are severe:

- $10,000 penalty for initial failure

- Up to $50,000 for continued noncompliance after IRS notice (civil penalty assessment prior to further enforcement)

- Criminal penalties may apply for willful violations

- The IRS may keep the statute of limitations open indefinitely if assets are not reported

- These are in addition to FBAR penalties

For more detailed answers about potential fines, late filing consequences, and how to avoid them, check out our full FAQ on tax penalties and fines for U.S. expats here. It’s a helpful resource if you’re looking to better understand the risks and how to stay compliant.

How to File Form 8938?

Filing IRS Form 8938, Statement of Specified Foreign Financial Assets, involves several steps to a foreign financial asset to ensure compliance with the Foreign Account Tax Compliance Act (FATCA). Here’s how to go about it:

STEP 1: Determine if you are required to file Form 8938:

- Are you a U.S. citizen, resident alien, or certain nonresident aliens?

- Do you have “specified foreign financial assets” that exceed the reporting thresholds? The thresholds vary based on your filing status and whether you live abroad.

STEP 2: Gather information on your specified foreign financial assets:

- This includes foreign bank accounts, investment accounts, pensions, insurance policies, and other foreign financial instruments.

- Determine the total value of these assets as of the last day of the tax year, as well as the maximum value during the year.

STEP 3: Complete Form 8938:

- Fill out all the required sections of the form, including identifying information, details on your specified foreign financial assets, and any other foreign information returns you have filed.

STEP 4: Attach Form 8938 to your annual tax return:

- Form 8938 must be filed with your Form 1040 (or other applicable annual return) by the due date of that return, including any extensions.

How Does the IRS Know If I Haven’t Filed Form 8938?

Since the enactment of the Foreign Account Tax Compliance Act (FATCA), international financial transparency has significantly increased. Under FATCA, foreign financial institutions (FFIs) are required to report information on financial accounts held by U.S. taxpayers directly to the IRS. This includes details on accounts holding cash, foreign stock, foreign mutual funds, foreign pensions and other specified foreign financial assets exceeding certain thresholds.

Many of our clients first become aware of their filing obligations when their bank or financial institution, located in a foreign country, reaches out to them regarding their obligation to report their foreign financial account information under FATCA. This automatic exchange of information has equipped the IRS with a robust mechanism to track compliance with Form 8938 filing requirements. If there’s a discrepancy between the information received from FFIs and your tax filings, or if the IRS receives information from a foreign financial institution about your foreign financial assets but you haven’t filed Form 8938, it could raise red flags, potentially leading to audits, penalties, or both.

How 1040 Abroad Can Help

Navigating the requirements of Form 8938 and understanding the broader implications of FATCA can be daunting, especially for U.S. expats living abroad. If you have any questions about your specific situation, or if you’re looking for tailored tax advice, don’t hesitate to reach out. We offer free tax advice via email to help you navigate your obligations with confidence. Contact us today to ensure your foreign financial assets are in full compliance with IRS requirements.