If you’re an American citizen living abroad and receive a U.S. Treasury check—whether it’s a tax refund, stimulus check, or another government payment—you may run into challenges when trying to cash or deposit it. Many foreign banks do not process U.S. paper checks, and even when they do, the process can be slow and expensive.

The easiest way to avoid this issue is to opt for direct deposit when filing your tax return. However, if you’ve already received a physical check and don’t have a U.S. bank account, here are your options for cashing a U.S. Treasury check overseas.

Option 1: Deposit the Check at Your Local Bank

Some banks in foreign countries will accept U.S. Treasury checks for deposit, but this varies by institution. Many banks will not process U.S. government-issued checks, while others may require you to wait weeks or even months for the check to clear. In most cases, the fees for these transactions are high.

Steps to Try Depositing at Your Local Bank:

- Check with your bank – Contact your local bank to see if they accept U.S. Treasury checks and ask about fees and clearing times. Some local banks may also offer services to cash checks, but this often comes with high fees and long processing times.

- Endorse the check properly – Sign the back of the check as required by your bank’s app or deposit rules.

- Complete a deposit slip – Some banks require a deposit slip when submitting a check deposit.

- Wait for funds to clear – If your bank accepts the check, be prepared for a long processing time before the money is deposited into your account.

Option 2: Open an SDFCU Bank Account (Best Hack for Expats!)

If your local bank won’t accept U.S. Treasury checks, and you don’t have a US bank account, one of the best solutions is to open an account with SDFCU (State Department Federal Credit Union).

What is SDFCU?

SDFCU is a U.S.-based financial institution that allows Americans overseas to open a U.S. bank account remotely. Unlike many banks, SDFCU accepts expats living abroad and provides online banking, electronic payments, and easy access to U.S. financial services.

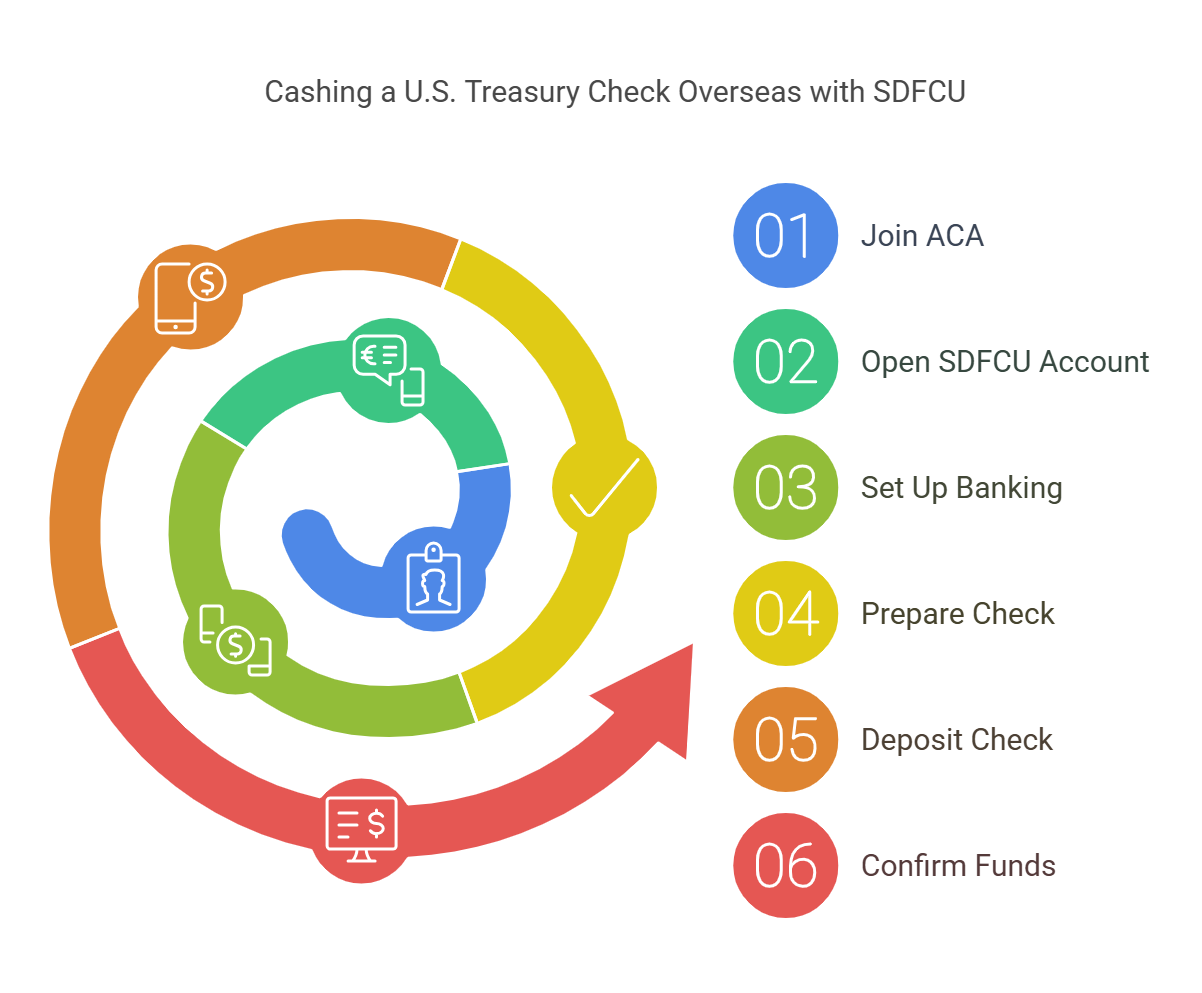

How to Open an SDFCU Account from Abroad?

To become eligible, you must first join the American Citizens Abroad (ACA) organization.

What is ACA?

The American Citizens Abroad (ACA) is a nonprofit group advocating for the rights of U.S. expats. By becoming a member, you gain access to SDFCU’s services.

Steps to Open an Account with SDFCU:

- Join ACA – Visit the ACA website and pay a membership fee (around $70 per year).

- Apply for an SDFCU Account – After joining ACA, you will receive instructions to open an account with SDFCU.

- Provide required documents – You’ll need a valid U.S. address (can be a family member’s or mail forwarding service), passport, and proof of residency.

- Start using your account – Once approved, you can use SDFCU for online banking, electronic payments, and check deposits from abroad.

With an SDFCU account, you can deposit your U.S. Treasury check remotely, eliminating the need for a local bank that might reject it.

Other Options for Cashing a U.S. Treasury Check Overseas

If the above options don’t work for you, consider these alternatives:

1. Mailing the Check to a U.S. Bank Account (If You Have One)

If you already have a U.S. bank account, you can mail the check to your bank for deposit. Contact your bank to ask if they allow this and follow their instructions carefully.

2. Using a Check-Cashing Service

Some check-cashing services, such as Credit Suisse (in Switzerland) and certain money exchange offices, might cash U.S. Treasury checks. However, these options usually come with high fees.

3. Asking a Trusted Person in the U.S. to Deposit on Your Behalf

If you have a trusted family member or friend in the U.S., you might be able to endorse the check and have them deposit it into their account. However, some banks don’t accept third-party deposits.

Avoid Paper Checks in the Future – Use Wise for Direct Deposit

If you haven’t filed your tax return yet but are expecting a refund, you can avoid the hassle of cashing a U.S. Treasury check overseas by choosing direct deposit instead.

Why Choose Wise?

Wise provides a U.S. account number and routing number, allowing you to receive U.S. Treasury payments directly into your account, even if you live in a foreign country. This is an excellent solution for expats who don’t have a U.S. bank account.

How to Set Up Direct Deposit with Wise:

- Open a Wise account at Wise.com and activate your USD balance.

- Get a U.S. account number and routing number from Wise.

- Use these details on your tax return to receive electronic payments instead of a physical check.

By setting up direct deposit with Wise, you can avoid the delays, fees, and difficulties of cashing a paper check abroad.