Navigating the complexities of U.S. tax compliance and international taxation can be challenging, especially for U.S. expatriates. One form that often goes unnoticed but carries significant penalties for non-compliance is Form 3520-A, which is mandated by the internal revenue code as part of the regulatory framework for foreign trusts with U.S. owners. For income tax purposes, it is crucial for U.S. taxpayers to report income generated from foreign assets to ensure proper tax compliance. In this article, we’ll delve into what Form 3520-A is, who needs to file it, and the penalties for failing to do so.

Key Takeaways

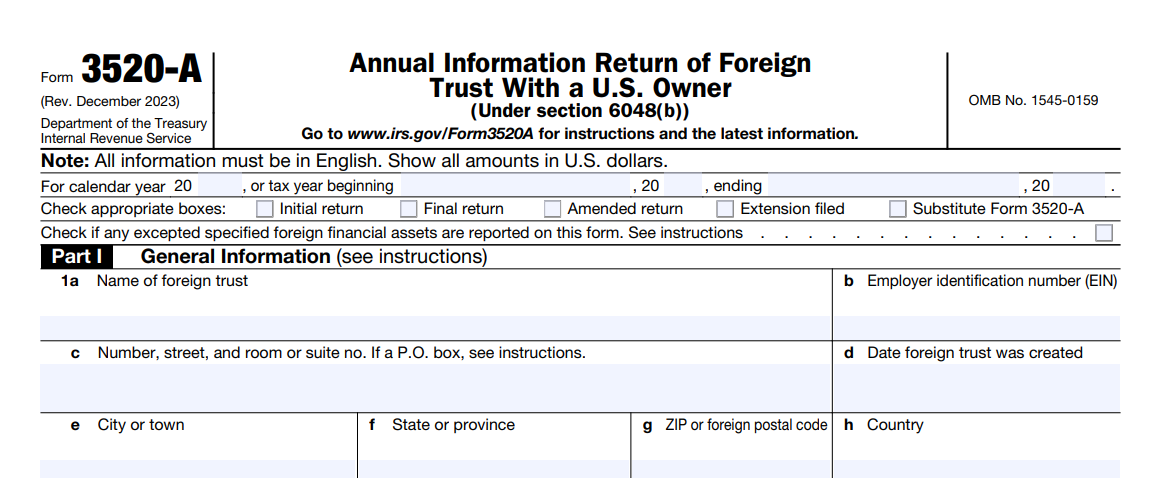

- Understanding Form 3520-A: Form 3520-A, the “Annual Information Return of Foreign Trust With a U.S. Owner,” is a crucial IRS form for U.S. expats who own or have interests in foreign trusts. It requires detailed reporting of all trust activities and financial operations.

- Filing Responsibility: Typically, the trustee of the foreign trust must file the form. If there is no U.S. agent, the U.S. owner must ensure compliance. The filing deadline is March 15th for calendar year trusts.

- Severe Penalties for Non-Compliance: Failing to file Form 3520-A results in an automatic $10,000 penalty that cannot be appealed. Awareness of this requirement is essential to avoid such penalties.

What is Form 3520-A?

Form 3520-A, also known as the “Annual Information Return of Foreign Trust With a U.S. Owner,” is a tax form required by the Internal Revenue Service (IRS) to report information about foreign trusts. Under U.S. Treasury regulations, trusts are arrangements where trustees hold property for beneficiaries under the ordinary rules applied in chancery or probate courts. If you are a U.S. person who is treated as the owner of any part of the assets of a foreign trust, you are obligated to ensure that this form is filed annually as part of your income tax return.

Who Must File Form 3520-A?

The responsibility for filing Form 3520-A generally falls on the trustee of the foreign trust. However, if the foreign trust does not have a U.S. agent, the U.S. owner must ensure that the form is filed. A U.S. owner is defined as a U.S. person, including foreign persons who are treated as the owner of any part of the assets of a Foreign Grantor Trust under the grantor trust rules.

When is Form 3520-A Due?

Form 3520-A must be filed by the 15th day of the 3rd month following the end of the trust’s tax year, usually March 15th for calendar year taxpayers. It is crucial to timely file Form 3520-A to meet this deadline, as failure to do so can result in hefty penalties.

Penalties for Failure to File Form 3520-A

Warning: Failure to file Form 3520-A results in an automatic $10,000 penalty assessed by the Internal Revenue Service. This is not a penalty you can appeal; it’s automatic. The IRS does not offer Abatement of Penalties for this. In our experience, this is one of the only penalties that U.S. expats consistently face because they are often unaware that the form needs to be filed by March 15th.

Reporting Requirements for Foreign Trusts on Form 3520-A

The form requires detailed financial information to report transactions involving the foreign trust and its financial accounts, including but not limited to:

- The name of the trust and the U.S. owner

- Identification of all U.S. beneficiaries who received distributions

- A full accounting of the trust’s assets and liabilities

- The trust’s income statement

- Any changes in the trust’s asset composition, including foreign accounts

What Types of Transactions Must be Reported?

All transactions involving the foreign trust’s assets must be reported. This includes reportable events such as:

- Contributions to and distributions from the trust

- Sales and purchases of assets

- Loans and loan repayments

- Certain foreign gifts, which require completing specific IRS forms like Form 3520 to disclose these transactions

- Any other financial activities affecting the trust’s assets or foreign estate

What Information is Required on the Form?

Form 3520-A is a comprehensive document that requires various pieces of information, including:

- The name, address, and taxpayer identification number of the foreign trust or foreign entity

- The name and address of the U.S. agent for the foreign trust

- Detailed financial statements, including an income statement and a balance sheet, which must report any foreign asset

- Information about distributions made during the year, if any

- Information about the U.S. person treated as the owner of the trust

- Annual statements from the financial institution where the trust’s assets are held

Additional Considerations for Form 3520-A

While the primary focus of Form 3520-A is on foreign trusts, it’s essential to understand that the form is part of a broader framework of international taxation and reporting requirements for U.S. expats. This includes the implications for U.S. owners of Canadian retirement plans, who must be aware of their filing obligations. Additionally, custodians of certain Canadian retirement plans, where U.S. persons hold an interest, are exempt from the requirement to file Form 3520-A. The IRS is increasingly scrutinizing foreign accounts and assets held by U.S. persons, making it crucial to stay updated on your tax obligations.

Common Mistakes to Avoid

One common mistake is the failure to recognize the need for filing Form 3520-A or filing it after the deadline, especially among those who are new to the complexities of international taxation. Another mistake is the incorrect classification of foreign entities, which can lead to non-compliance and penalties.

Form 3520-A is a critical tax form for U.S. expats, including nonresident alien individuals, who are treated as owners of foreign trusts. The deadline for filing is March 15th, and failure to comply results in an automatic $10,000 penalty that cannot be appealed. Given the complexity of the form and the severe penalties for non-compliance, it’s highly recommended to consult a tax professional to ensure that you meet all your reporting and tax obligations. Stay informed and stay compliant to avoid unnecessary financial burdens.

At 1040 Abroad, we understand the challenges that come with this form, and we’re committed to assisting you in this journey. What sets us apart is our dedication to providing value to our clients and leads. Not only do we offer expert guidance on Form 3520-A, but we also prepare it free of charge when you choose us to handle Form 3520. Additionally, we extend the courtesy of unlimited email consultations to ensure that you have the support you need.

Get Free Tax Advice Today

Your financial well-being is our priority, and we encourage you to make informed decisions to avoid unnecessary financial burdens. By partnering with us, you’re not just getting a service; you’re gaining a reliable ally in staying compliant with your tax obligations. Trust in our expertise, and let us help you navigate the complexities of tax reporting while residing abroad. Your peace of mind is worth it. Contact us today to take advantage of our expertise and make informed decisions about your financial well-being. Your peace of mind is our priority. Reach out now and let us assist you in navigating the intricacies of tax reporting while living abroad.