No, it’s not too late. You can still claim your 2021 stimulus check by filing for the Recovery Rebate Credit on your 2021 tax return. Whether you’re a U.S. citizen abroad or haven’t filed yet, act now to claim up to $1,400 before the IRS deadline.

Key Takeaways

- U.S. expats must file their 2021 tax return by June 15, 2025

- To be eligible for stimulus payments, individuals must meet criteria such as having a Social Security number, income thresholds, and not being claimed as a dependent on someone else’s tax return.

Understanding the Stimulus Check Deadline for Expats

The clock has run out for U.S. expats to claim their 2020 stimulus checks. However, the deadline to claim the 2021 stimulus check is still open until June 15, 2025. If you’re a U.S. expat and haven’t claimed your 2021 stimulus check yet, it’s time to take action.

How to Claim Your Missed Stimulus Checks Using the Recovery Rebate Credit?

To claim the missed 2021 stimulus check, follow these steps:

- File a 2021 Tax Return: Ensure you file your 2021 tax return by June 15, 2025.

- Claim the Recovery Rebate Credit: The 2021 stimulus check is not issued separately—it is claimed as the Recovery Rebate Credit on your 2021 tax return. When you file your 2021 tax return, this credit is applied, and if you are eligible, it will be included in your tax refund.

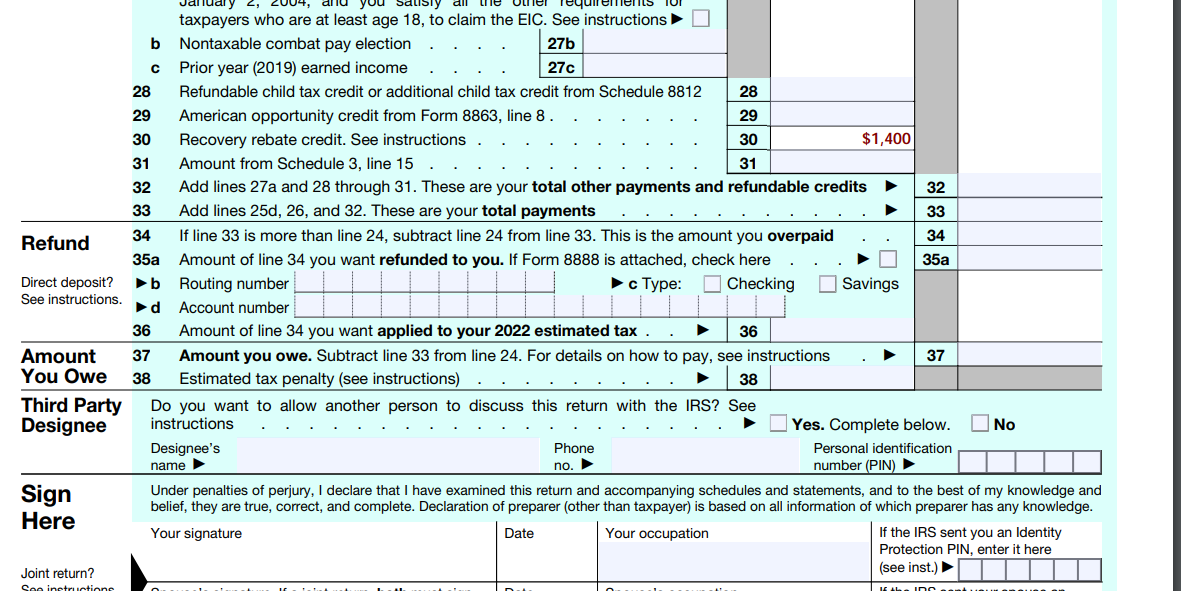

You claim the Recovery Rebeta Credit on Line 30

It’s crucial to file your tax return accurately and ensure all necessary documents are in order to become tax compliant. Expats can also claim stimulus checks by utilizing the IRS streamlined procedures to recover missed payments they were eligible for but did not receive.

Catch Up on Taxes & Claim Your Stimulus Check Without Penalties

If you haven’t filed your 2021 tax return, you can still claim your stimulus check while becoming tax compliant through the IRS Streamlined Filing Compliance Procedures. This program is designed for U.S. expats who failed to file tax returns in past years but want to catch up without penalties. It allows eligible individuals to file three years of tax returns and six years of FBARs (if required) while avoiding IRS fines.

Couples who are married filing jointly can benefit from higher income thresholds for stimulus payments.

By using this amnesty program, you can file your 2021 tax return, claim the Recovery Rebate Credit, and receive your third stimulus check if you qualify. The IRS does not automatically issue payments to those who have not filed, so taking action now ensures you don’t miss out. If you need to get compliant and claim your missed stimulus check, this program is your best option to do so safely and penalty-free.

The deadline to file a 2021 tax return and claim the stimulus payment is June 15, 2025. If you qualify for the Streamlined Procedures, now is the time to act and secure both your tax compliance and any stimulus money still owed to you.

Eligibility Criteria for Claiming Stimulus Checks

To qualify for the third stimulus check (2021 economic impact payment), you must be a U.S. citizen or qualifying resident alien with a Social Security number, meet the income requirements, and not be claimed as a dependent on someone else’s tax return.

The full payment is available for individuals with an adjusted gross income (AGI) up to $75,000, $150,000 for married couples filing jointly, and $112,500 for heads of household. Payments phase out for higher earnings, with no stimulus available for individuals earning over $80,000, married couples earning over $160,000, and heads of household earning over $120,000.

If you didn’t receive the third stimulus check, you must file a tax return for tax year 2021 to claim the Recovery Rebate Credit. The IRS does not automatically issue this payment, so US expats must take action before the June 15, 2025 deadline.

If you have children or adult dependents, you’re in for good news. You may be eligible for an increased amount of money in your stimulus check. This additional amount can provide significant financial relief, helping you cover essential expenses for your dependent.

Direct Deposit vs. Mailed Checks: The Best Way to Receive Your Stimulus Payment

If you’re a U.S. expat eligible for a stimulus check or tax refund, choosing direct deposit is the fastest and most secure way to receive your economic impact payment. If you have a U.S. bank account, you can provide your details to the IRS when you file your tax return and avoid delays.

If you don’t have a U.S. bank account, the IRS will issue a paper check, which can be difficult to cash while living abroad. Many foreign banks won’t accept U.S. Treasury checks, and mailing delays can create further complications. If you receive a government-issued payment by check and need to deposit it outside the U.S., we’ve covered the best options in this guide: How to Cash Treasury Checks Abroad.

To ensure you receive your stimulus money without issues, update your banking details with the IRS when filing your 2021 tax return and avoid relying on a mailed check.

Get Help Claiming Your Stimulus Check

If you still need to claim your 2021 stimulus check, you must file a 2021 tax return before June 15, 2025. At 1040 Abroad, we specialize in expat tax services and can help you file accurately to claim any missed stimulus payments.

Need guidance? We offer free tax advice. Our Enrolled Agents are here to answer your questions—don’t hesitate to contact us today!