Starting January 1, 2024, a crucial new mandate requires businesses to engage in beneficial ownership information reporting. The Financial Crimes Enforcement Network (FinCEN) now requires certain entities to disclose their beneficial owners to enhance transparency and combat illicit activities. This comprehensive guide will explain what beneficial ownership information is, how to determine beneficial ownership, reporting requirements, penalties for non-compliance, who needs to file a BOIR in 2024, and specific requirements for LLCs.

What is Beneficial Ownership Information (BOIR)?

Beneficial Ownership Information (BOIR) refers to details about individuals who own or control a company. This information is essential for ensuring transparency and preventing the misuse of corporate structures for illicit activities such as money laundering and terrorism financing. BOIR is a key component of the Corporate Transparency Act, which aims to increase the accountability of business entities.

How to Determine Beneficial Ownership?

A beneficial owner is an individual who owns at least 25% of a company or has substantial control over it. To determine beneficial ownership, consider the following steps:

- Identify Individuals with Substantial Control: These include senior officers, key decision-makers, and individuals with significant influence over the company’s operations.

- Assess Ownership Interests: Look at equity, stock, voting rights, capital or profit interests, and other mechanisms establishing ownership.

- Calculate Ownership Percentages: Determine if individuals hold 25% or more of these interests.

Reporting Requirements for BOIR

Starting January 1, 2024, reporting companies must file initial BOIR reports to FinCEN. A reporting company created or registered on or after January 1, 2024, has 30 calendar days from the time the company receives actual notice of its creation or registration to file its initial beneficial ownership information report. These reports must include:

- Company Details: Information about the reporting company, such as name, address, and entity type.

- Beneficial Owners’ Information: Details of beneficial owners, including their full legal name, date of birth, address, and unique identifying number (such as a passport or driver’s license number).

- Company Applicants’ Details: For companies created or registered after January 1, 2024, information about the individuals involved in the company’s creation or registration must be included. Reporting companies created or registered before January 1, 2024, must file their initial BOIR by January 1, 2025.

Reports must be filed electronically using FinCEN’s secure filing system. Additionally, updates are required whenever there are changes to the beneficial owners or control of the company. For a reporting company created or registered after January 1, 2024, the initial BOIR must include information about the individuals involved in the company’s creation or registration.

Penalties for Non-Compliance

Failure to comply with BOIR reporting requirements can result in significant penalties:

- Civil Penalties: Up to $500 per day for ongoing violations.

- Criminal Penalties: Fines up to $10,000 and/or imprisonment for up to two years.

Voluntarily correcting inaccurate information within 90 days of the original deadline may provide a safe harbor from penalties.

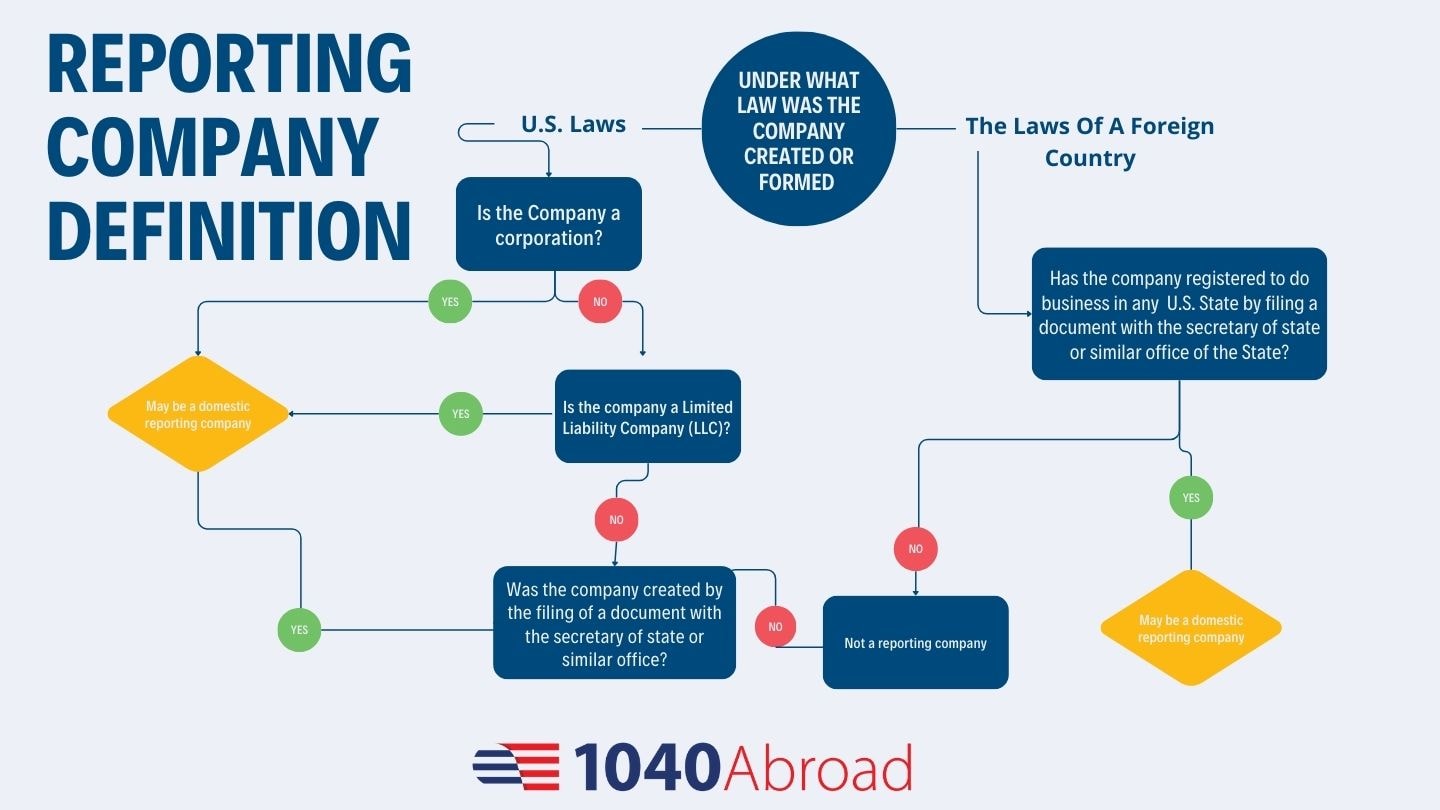

Who Needs to File a BOIR in 2024?

All entities that meet the definition of a “reporting company” must file a BOIR unless they qualify for an exemption. Entities must report their company’s beneficial ownership information to FinCEN to comply with the Corporate Transparency Act. This includes:

- Domestic Companies: Any entity created by the filing of a document with a secretary of state or similar office.

- Foreign Companies Registered to Do Business in the US: Any entity formed under the laws of another country that is registered to do business in the United States. Foreign companies registered to do business in the US must also report their ownership information to FinCEN.

- Limited Liability Companies (LLCs): Many Non-Resident Alien (NRA) clients with US LLCs will need to file this form, starting January 1, 2024.

BOIR for LLCs

For LLCs, particularly those owned by non-resident aliens, the new BOI reporting requirements starting in 2024 are crucial. LLCs must report detailed information about their beneficial owners to ensure transparency and compliance with FinCEN regulations. This includes identifying individuals with substantial control or 25% or more ownership in the company.

What is a BOIR for LLCs?

A BOIR for LLCs includes comprehensive details about the company’s beneficial owners. The report ensures that all ownership information is transparent and meets regulatory requirements. LLCs must report information about their beneficial owners, including names, addresses, and identifying numbers, to ensure compliance with FinCEN regulations. The key elements of the BOIR include:

- Beneficial Owners Identification: Names, addresses, and identifying numbers of individuals with significant control or ownership.

- Ownership Structure: Details about the ownership interests, such as shares or equity percentages.

Penalties for Non-Compliance

Failing to comply with BOI reporting requirements can result in severe penalties. These include:

- Civil Penalties: Up to $500 per day for ongoing violations.

- Criminal Penalties: Fines up to $10,000 and/or imprisonment for up to two years.

Voluntarily correcting inaccurate information within 90 days of the original deadline may provide a safe harbor from penalties.

How Much Does It Cost to File a BOIR?

Our fee for preparing and filing a BOIR is $150. This fee covers the complete preparation and submission process, ensuring compliance with the new regulations.

How Do I Know If I Need to File a BOIR?

Determining whether you need to file a BOIR involves considering several factors:

- Does Your Company Meet the Definition of a Reporting Company? If your company is a domestic or foreign entity registered to do business in the US, it likely needs to file a BOIR.

- Are You a Beneficial Owner? If you have 25% or more ownership or substantial control over the company, you are considered a beneficial owner.

- Is Your Company a Limited Liability Company (LLC)? LLCs are required to report beneficial ownership information starting January 1, 2024.

For further clarification, contact us for a free email consultation. We can help determine your reporting requirements and ensure you comply with the new regulations.

Additional Information

Important Compliance Notice: Reporting companies must keep their BOIR up-to-date, reporting changes to beneficial ownership or control within 30 days. Reporting companies must file their initial BOIRs within 30 days of the company’s creation or registration.

Receiving Actual or Public Notice: Companies will receive actual notice or public notice regarding reporting obligations.

For more detailed information and assistance with BOI reporting, please contact us directly.

Beneficial Ownership Information (BOIR) reporting is a critical requirement for transparency and compliance starting January 1, 2024. Companies must report beneficial ownership to FinCEN, ensuring that all ownership information is accurate and up-to-date. This guide provides a comprehensive overview of who needs to file, what information is required, and the penalties for non-compliance. If you are unsure whether you need to file a BOIR, contact us for a free email consultation to ensure you meet all BOIR reporting requirements.