Taxes can be complicated especially when you have income from foreign sources. One great tool to avoid double taxation on international income is the Foreign Tax Credit (FTC). This credit allows you to offset the income taxes you paid to foreign governments against your US tax liability, provided they are an actual foreign tax liability, so you’re not taxed twice on the same income.

But what happens when the amount of foreign tax paid exceeds the limits of the FTC for a given year? That’s where Foreign Tax Credit Carryover comes in. The carryover provision allows you to apply unused foreign tax credits to past or future years so you can maximize the benefit and not let any credit go to waste.

Foreign Tax Credit Carryover is important if you have ongoing international financial interests. This article will explain what a carryover is, how it works and why it’s a key part of tax planning.

What is Foreign Tax Credit Carryover?

Foreign Tax Credit (FTC) carryover, also known as foreign tax credit carryovers, is a provision that allows US taxpayers to use unused foreign tax credits that couldn’t be used in the current year. This mechanism helps reduce double taxation on foreign income by allowing you to carry forward or carry back excess foreign taxes paid.

How it Works

- Carryback: You can carry back excess foreign tax credits to the previous year. So if you have excess credits this year, you can apply them to reduce your tax liability from last year. This carryback is limited to one year.

- Carryforward: If the foreign tax credits are still unused after the carryback, you can carry them forward for up to 10 years. You can apply these credits against future tax liabilities on foreign income.

Examples

Example 1: You paid foreign taxes of $5,000 in 2023 but could only use $3,000 of that as a Foreign Tax Credit due to your U.S. tax liability on the foreign income was only $3,000. The remaining $2,000 can be carried back to 2022. If you had a U.S. tax liability on foreign income in 2022, you can apply the $2,000 carryback to offset the 2022 liability. This may reduce your 2022 tax liability and result in a refund.

Example 2: Carryforward

You paid $5,000 in foreign taxes in 2023, but your U.S. tax liability on the foreign income only allowed you to use $3,000 of that as a Foreign Tax Credit. The remaining $2,000 can either be carried back to 2022 or carried forward to future years. If you choose to carry it forward, you can apply the unused $2,000 to any year from 2024 to 2033, depending on your foreign income and tax situation in those years.

Notes

- Flexibility: You can choose whether to carry back or carry forward any unused portion of your Foreign Tax Credit. If you decide to carry it forward, you have up to 10 years to use it.

- Strategic Planning: It’s important to consider your expected foreign income and U.S. tax liabilities in future years. If you anticipate higher foreign income or U.S. tax liability in future years, carrying the credit forward could maximize its benefit.

- Tax Filing: Keep track of any carryovers each year. You’ll need to report them on your tax returns when you use them in future years.

- Limitations: The amount of Foreign Tax Credit you can use in any given year is limited to your U.S. tax liability on your foreign income for that year. This makes it essential to plan how and when to apply carryovers for the best tax outcome.

- If not used within the timeframes, credits will expire.

Who is Eligible for Foreign Tax Credit Carryover?

To use the Foreign Tax Credit Carryover, you must first be eligible to claim the Foreign Tax Credit itself. This generally applies to U.S. taxpayers who have paid or accrued foreign taxes on income that is also subject to U.S. taxation. If the amount of foreign taxes paid exceeds the limit you can use in a given year, the unused portion can be carried back one year or carried forward up to ten years.

Key Points

To be eligible for Foreign Tax Credit Carryover you must:

- Foreign Tax Paid or Accrued: You must have paid or accrued foreign taxes that qualify as an actual foreign tax liability for the Foreign Tax Credit. These taxes must be imposed on you directly and the income on which the foreign tax was paid must also be subject to US tax.

- Carryover Eligibility: If the amount of foreign taxes paid or accrued exceeds your U.S. tax liability on foreign income in a given year, the unused credit can be carried back to the prior year or carried forward for up to ten years.

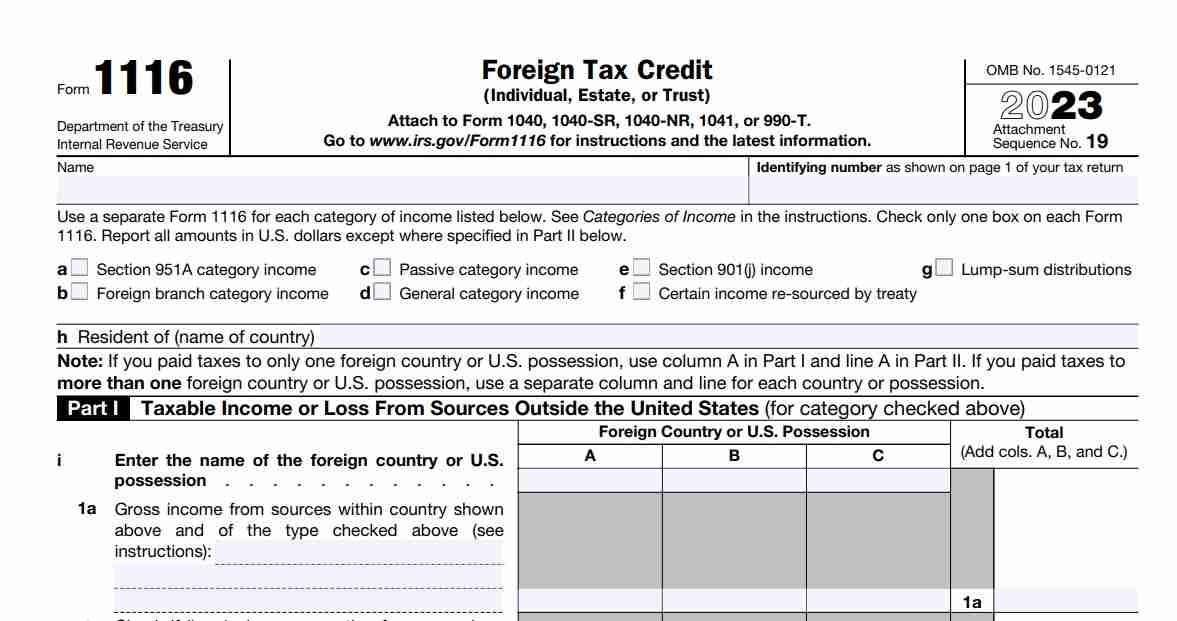

- File a US Tax Return: You must file a US tax return and the Foreign Tax Credit must be claimed on IRS Form 1116, “Foreign Tax Credit (Individual, Estate, or Trust).” The carryover must also be shown on this form.

Which Foreign Taxes Qualify for the Foreign Tax Credit and Carryover?

Not all paid foreign taxes qualify for the Foreign Tax Credit or carryover. Eligible taxes are:

- Income Taxes: Taxes imposed by a foreign country on your income including wages, interest, dividends and business profits.

- Certain Foreign Withholding Taxes: Taxes withheld at the source by a foreign government on income earned within that country.

- Taxes in Treaty Countries: Taxes paid to countries that have a tax treaty with the US are often eligible for the FTC and carryover.

Not all taxes qualify, like value-added taxes (VAT) or property taxes.

How to Calculate Foreign Tax Credit Carryover?

Calculating the Foreign Tax Credit (FTC) Carryover is crucial for maximizing the benefit of the foreign taxes you’ve paid. This involves determining the unused FTC from the current year and how much can be carried forward or backward to other tax years. Accurate calculations are critical to complying with IRS rules and avoiding costly mistakes.

Step-by-Step Guide

1. Foreign Income and Taxes Paid

First, list all the foreign income you earned during the tax year that’s subject to U.S. tax. This includes salaries, dividends, interest, and capital gains. Then, total up the foreign taxes you paid or accrued on that income.

Example: Sarah worked in France all year and earned $70,000 (after converting euros to U.S. dollars). She also earned $3,000 in interest from her savings account in a French bank. Total foreign taxes paid were $15,000 on her salary and $600 on her interest income.

2. Categorize Income

Now, categorize your foreign income into two main categories: general category income and passive category income. General category income includes salaries and pensions, while passive category income includes dividends, interest, and rental income.

In Sarah’s Case:

- $70,000 salary is general category income.

- $3,000 interest income is passive category income.

3. FTC Limit for Each Category

Your FTC limit is determined by the amount of U.S. tax liability attributable to your foreign income in each category. This is the maximum amount of FTC you can claim, which is a dollar-for-dollar credit against the U.S. taxes owed on that foreign income.

For Sarah:

- General Category Income: Sarah’s U.S. tax liability on her $70,000 salary is $12,000. Although she paid $15,000 in French taxes, she can only claim $12,000 as a credit, which means $3,000 is unused and can be carried over.

- Passive Category Income: Sarah’s U.S. tax liability on her $3,000 interest income is $500. Although she paid $600 in French taxes, she can only claim $500 as a credit, leaving $100 as unused FTC that can be carried over.

4. Unused FTC

If the foreign taxes you paid exceed the U.S. tax liability on your foreign income, the excess is considered unused FTC. This excess can be carried over to other tax years.

For Sarah:

- General Category Income: Sarah can use $12,000 of the $15,000 she paid in French taxes as a credit, leaving $3,000 as unused FTC.

- Passive Category Income: Sarah can use $500 of the $600 she paid in French taxes as a credit, leaving $100 as unused FTC.

5. Carryback and Carryforward

Sarah can decide whether to carry back the $3,100 unused FTC (combined from both categories) to the previous year or carry it forward to future years. She can carry back the FTC for one year or carry it forward for up to 10 years.

6. Document Everything

Use IRS Form 1116 to document your FTC calculation, including any carryover amounts. While you don’t need to submit proof of foreign taxes paid with your tax return, it’s crucial to keep these documents for at least five years in case of an audit. Ensure all figures are accurate and supported by documentation like foreign tax receipts and income statements.

What Are the Key Filing Requirements and Forms for Claiming Foreign Tax Credit Carryover?

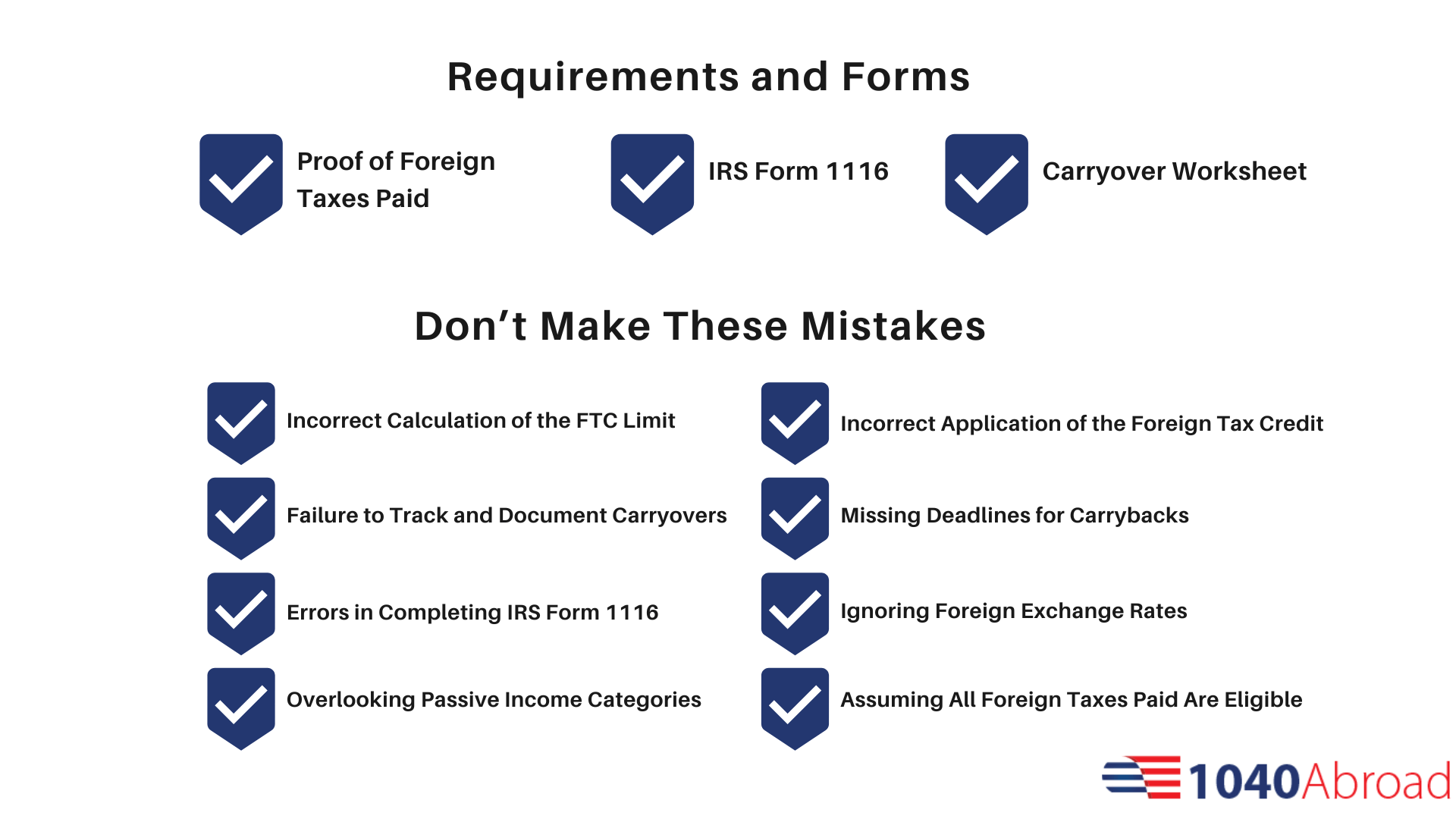

Proper documentation is essential when claiming a Foreign Tax Credit Carryover. The required documents include:

- Proof of Foreign Taxes Paid: You should keep receipts, statements, or other official documents that show the amount of foreign taxes paid or accrued. While you don’t need to submit these with your tax return, it’s important to retain them for at least five years in case of an IRS audit.

- IRS Form 1116: This form must be completed and attached to your U.S. tax return each year you claim a carryover. It details the foreign income, taxes paid, and the Foreign Tax Credit calculation.

- Carryover Worksheet: The IRS provides a worksheet to track your carryover amounts, both for carrybacks and carryforwards. It’s crucial to maintain accurate records of these amounts each year to ensure proper credit application.

Don’t Make These Mistakes

Incorrect Calculation of the FTC Limit:

One of the most frequent mistakes is the incorrect calculation of the FTC limit. This occurs when taxpayers miscalculate the amount of U.S. tax liability attributable to their foreign income. Such errors can result in either underclaiming or overclaiming the credit, potentially leading to lost credits or disputes with the IRS.

Failure to Track and Document Carryovers:

Another common error is the failure to properly track and document carryovers. Taxpayers must maintain accurate records of both carrybacks and carryforwards to avoid confusion in future tax years. Inadequate documentation can lead to incorrect claims or the loss of valuable tax credits.

Errors in Completing IRS Form 1116:

Mistakes in completing IRS Form 1116 are also frequent. These errors include incorrect categorization of income and failing to attach the required form. Such mistakes can cause processing delays, reduce the allowable credit, or result in the disallowance of the credit altogether.

Overlooking Passive Income Categories:

Neglecting to properly categorize passive income, such as dividends and interest, separately from general income can lead to incorrect FTC calculations. This oversight may cause taxpayers to miss out on credits available for passive income.

Incorrect Application of the Foreign Tax Credit:

Another common mistake is incorrectly applying the FTC to income that is not eligible, such as income not subject to U.S. tax or foreign taxes that do not qualify for the FTC (e.g., VAT or property taxes). This can result in the disallowance of the credit and possible penalties or interest charges from the IRS.

Missing Deadlines for Carrybacks:

Failing to file an amended return in time to claim a carryback is another common error. Missing the window for a carryback can result in the loss of a potential refund for the previous year.

Ignoring Foreign Exchange Rates:

Using incorrect foreign exchange rates when converting foreign taxes paid to U.S. dollars is another frequent mistake. This error can lead to inaccuracies in the amount of FTC claimed, potentially reducing the credit or attracting IRS scrutiny.

Assuming All Foreign Taxes Paid Are Eligible:

Finally, some taxpayers mistakenly assume that all taxes paid to a foreign government are eligible for the FTC without verifying eligibility criteria. Ineligible taxes claimed for the FTC can result in disallowance and potential penalties.

How Can You Effectively Use Your Foreign Tax Credit Carryover?

To successfully claim your Foreign Tax Credit Carryover, you must adhere to the following filing procedures:

IRS Form 1116: This essential form, titled “Foreign Tax Credit (Individual, Estate, or Trust),” is used to calculate your FTC for the current year and to report any carryover amounts. You’ll need to submit a separate Form 1116 for each income category, such as general or passive income, ensuring the correct foreign tax credit calculation.

Form 1040 – U.S. Individual Income Tax Return: The total FTC, including any carryovers, should be reported on your Form 1040. Specifically, the credit is entered on the appropriate line of Schedule 3 (Additional Credits and Payments) before being transferred to your Form 1040, where it directly reduces your tax liability.

Carryover Tracking Worksheet: The IRS provides a worksheet within the Form 1116 instructions to help you monitor any unused credits carried over to future years. Keeping precise records of these carryover amounts is crucial, as they will be needed for future tax filings.

Struggling with Foreign Tax Credit carryovers? 1040 Abroad can help! Our expert team will ensure you get the most out of your foreign taxes and avoid double taxation. Visit 1040 Abroad to schedule a consultation and simplify your U.S. tax filings today.