For U.S. citizens living abroad, IRS Form 1116 is the key to avoiding double taxation on income earned in a foreign country. This form allows you to claim the Foreign Tax Credit, reducing your U.S. tax liability by the amount of foreign income taxes paid. By filing Form 1116, you ensure that you’re not taxed twice—once by the U.S. and again by the foreign country where your income was earned. Mastering this form is crucial for any U.S. expat looking to minimize their tax burden and keep more of their hard-earned money.

What is Form 1116 and who needs to file it?

Form 1116, officially known as the Foreign Tax Credit (Individual, Estate, or Trust), is an IRS form that U.S. taxpayers use to claim a credit for foreign taxes paid or accrued to a foreign country or U.S. possession on foreign income. The purpose of this form is to help U.S. taxpayers avoid double taxation—being taxed by both the U.S. and a foreign country on the same income.

Who Needs to File Form 1116?

You need to file Form 1116 if:

- You are a U.S. citizen or resident alien with foreign sourced income, such as wages, dividends, interest, or capital gains, that you’ve earned abroad and paid or accrued foreign taxes on.

- You want to claim the Foreign Tax Credit to reduce your U.S. tax liability by the amount of foreign taxes paid or accrued.

- You have income from a foreign country that is subject to both U.S. and foreign taxes, and you want to avoid paying taxes twice on the same income.

Most of the US international tax experts prefer claiming a Foreign Tax Credit (Form 1116) on a client’s U.S. tax return rather than the Foreign Earned Income Exclusion. This strategy involves understanding and effectively claiming foreign tax credits to avoid double taxation for U.S. expatriates and to minimize overall U.S. tax liabilities.

Read further to learn about how to file Form 1116 and why it is a better way to save money on your US expat taxes.

Related: Foreign Earned Income Exclusion vs. Foreign Tax Credit: which one is better?

Advantages of Foreign Tax Credit and General Rules

Claiming the Foreign Tax Credit will not only bring your tax owing to zero, it will allow you to make tax-deductible IRA contributions, claim the additional child tax credit, and carryforward those excess credits to future years. Individuals who pay foreign taxes may be eligible for significant benefits under the Foreign Tax Credit, highlighting the importance of understanding one’s legal obligations and opportunities when living abroad.

The Additional Child Tax Credit

In order to qualify for the additional child tax credit, taxpayers must have at least $3,000 of earned income. If you exclude all your foreign-earned income with the foreign earned income exclusion, you have no taxable income on your tax return that would qualify you for the ACTC. Many expats miss out on the ACTC each year not knowing they could claim the FTC and the ACTC.

IRA Contributions

The same rules apply to your IRA contribution. You must have earned income to contribute to your IRA. If you use the FEIE, you won’t have earned income that could be contributed.

Related: 5 things to know about IRAs for U.S. expats

Foreign Tax Credit Carryovers

You have an FTC carryover if you paid more foreign taxes (that is, taxes that were not subject to US income tax) than what you would have been liable for had you lived in the United States. An FTC carryover allows you to use that excess FTC from one year to offset one year’s prior tax liability or carry forward those excess credits to future years. You can find more on the advantages of the foreign tax credit here

Remember that you need to convert all of the foreign taxes paid to US dollars. The IRS prefers that you convert each transaction at the foreign exchange rate at the date of the transaction. However, if you choose to claim foreign income taxes on an accrual basis, you will have to use the annual average foreign exchange rate.

The eligible taxes include only passive category income and general category income.

Passive category income includes dividends, interest, rents, and royalties. Capital gains that are not considered active conduct of a trade or business also fall under Passive income. General category income may include wages, salary, and overseas allowances. The latter category also includes income earned in the active conduct of a trade or business

There are other limitations on certain foreign taxes that you cannot claim as a foreign tax credit. For example, the Foreign Tax Credit doesn’t apply against any tax paid to North Korea, Iran, Sudan or Syria.

Ready to simplify your U.S. tax questions? Schedule a 20-minute consultation with our tax expert today!

Book your spot here.

How to qualify for the Foreign Tax Credit?

- The tax must be actual foreign tax liability and legally derived

- The tax must be imposed on you

- You must have paid or accrued the tax, and

- The tax must be an income tax or Tax in Lieu of Income Tax

The Foreign Tax Credit is designed to prevent double taxation on the same income earned abroad and taxed by both the U.S. and a foreign country.

Following Foreign Taxes That Do Not Qualify:

- Taxes refundable to you

- Taxes subsided you or someone related to you

- Taxes you could have avoided paying as they are not required by law

- Withheld foreign taxes on dividends for foreign stocks and they don’t meet required minimum holding periods

- Withheld foreign taxes on gains and income from other foreign properties that don’t meet required minimum holding periods

Tax Tip 1

If you were using Foreign Earned Income Exclusion and then decided to revoke it, you can’t use it again for another 5 years. But if you use the Foreign Tax credit, you can revert to the FEIE.

One of the multiple benefits of Foreign Tax Credit (Form 1116) is that it doesn’t require additional information. So you don’t have to submit details about housing, visa type held in the foreign country, or your travels and duration of stay in the U. S. Another advantage is that to claim Foreign Tax Credit, you don’t need to pass any of the residence tests as opposed to the Foreign Earned Income Exclusion which requires applicants to pass the Bona Fide Residence Test or Physical Presence Test

How to calculate the foreign tax credit and fill out Form 1116? (Example)

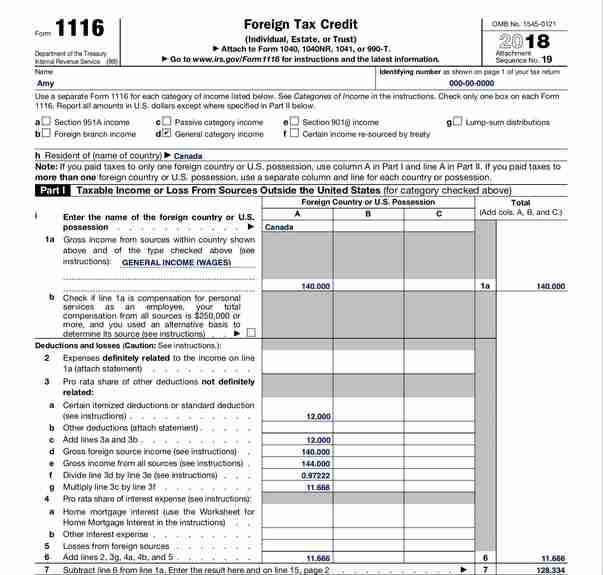

Amy is an American living in Canada. She had $140,000 of employment income and $4000 of income in dividends. Amy will use the advantage of the standard deduction that’s $13,850 for single filers in 2023. She has paid $29,602 tax for her wages and $722 tax for the dividend income. She does not claim itemized deductions.

Note: The amounts are shown in United States Dollars. Since the income comes from two different sources (General and Passive Category type of Income), Amy has to file two Foreign Tax Credit Forms 1116. One form for general category income and one form for the passive category income.

You cannot combine multiple categories of income and make the calculations using only one Form.

Step 1. Choose income category

Start by choosing the appropriate income category at the top of the form, (in case of the wages, check the box “general category income” and for investment income, check the box “passive category income”).

Passive Category Income includes interest, dividends and other investment income. Then, choose the taxpayer’s country of residence on the line H (in Amy’s case the country of residence will be “Canada”).

Step 2. Complete Part I

Here you need to report the income and name of the foreign country. Columns A, B, and C stand for multiple countries in which a taxpayer could earn income (in our first Foreign Tax Credit Form 1116, we will have only Canadian sourced wages under column A, as general type of income. You will need to do the same thing for the second form 1116).

From line 2 to line 5, the gross income from all sources is being reduced with deductions that relate to that foreign income (i.e. standard deduction which is $12,400 in the tax year 2021, for single taxpayers, or itemized deductions, if any). Deductions and losses related to exempt or excluded income such as Foreign Earned Income Exclusion cannot be reported here.

Line 3f explains the proportion of General Income with the Total Income, so we could know the amount of standard deduction which is attributable to General Income. The same method will be used when computing the numbers for Passive Category Income, in our second form 1116.

Line 3g represents the amount of standard deduction which is attributable to the specific income (In Amy’s case, she will have $11,666 of her standard deduction tied to her general income, while the rest will be tied to the passive income).

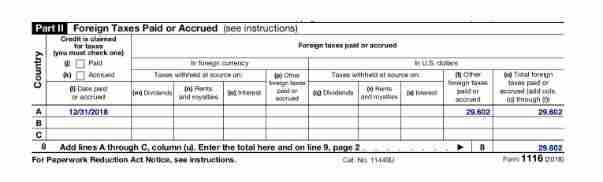

Step 3. Complete Part II. Paid or Accrued

This part will look the same as with the previous form. The amount of taxes paid for this category of income is the only difference here.

The taxes may be accrued or paid, depending on your accounting method.

One important thing is that if you choose the “accrued” box for the accrued taxes, you will have to credit foreign taxes in the year they accrue in all future returns. The date usually falls at the end of the calendar year. There are some exceptions here, like with the Dual status returns. In such a case, the date is used as the last calendar day the taxpayer is considered as a US citizen (the day of renunciation). More about this topic you can find here

The tax paid/accrued is reported underline A since the income in Amy’s case comes only from one foreign country.

Line A(t) will be the place where the amount of foreign taxes is reported. As we have the amounts that are already converted in USD. The method is the same for the Passive Category income.

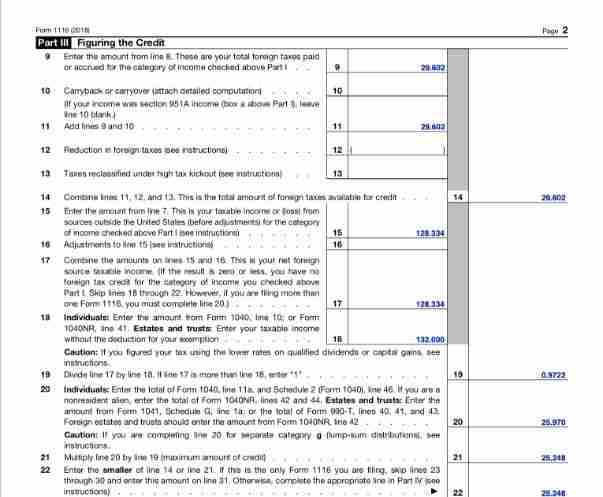

Step 4. Complete Part III. Computation of information.

Reported in previous parts of the form. From line 9 to line 20 there is information about taxes paid/accrued which have been transferred from Part II.

- Line 10 indicates potential carryback of carryovers from prior years. Mentioned in Tax Tip 2, but in Amy’s case, there aren’t any.

- Line 12 will indicate the reduction in foreign taxes. This usually occurs when the Foreign Earned Income Exclusion is claimed along with the Foreign Tax Credit.

- Line 15 reflects the calculation from Part II, line 7.

- Line 18 shows the taxable income calculated but dividing standard deduction from gross income of all sources.

- Line 20 represents the taxes imposed for both general and passive income.

- Line 22 shows a portion of US tax for General Category income

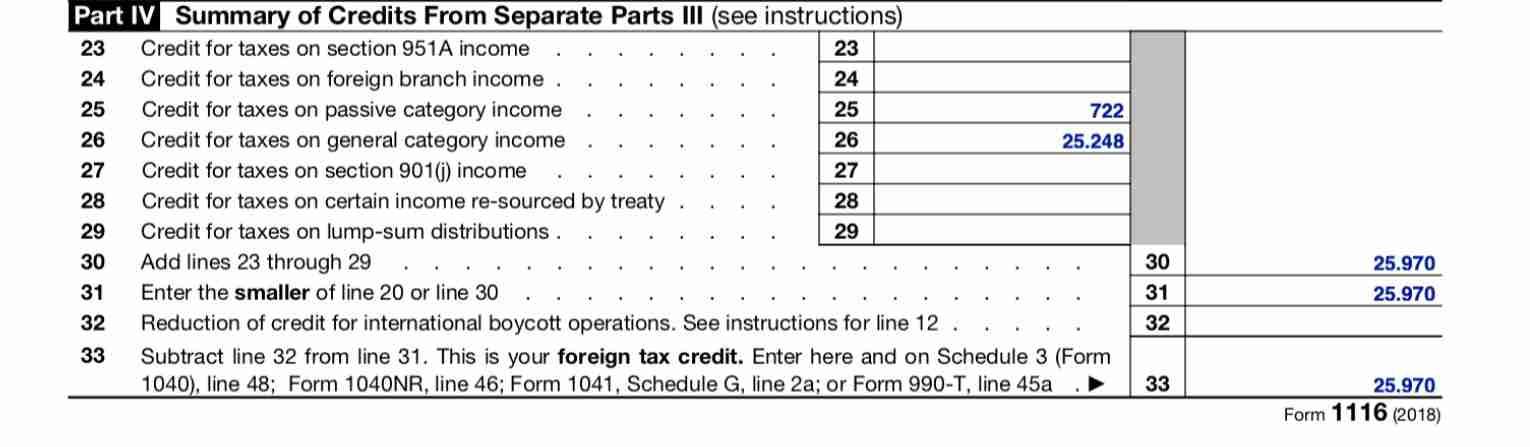

Step 5. Complete Part IV.

This part represents the information about the separate parts III. Like we have the situation with Amy. We are preparing two forms 1116, and therefore two different computations in Part III of the forms. The amount of tax credit that has been utilized to offset US tax owing is divided by the sourcing: taxes from general and taxes from passive income.

The same method is used when preparing Form 1116 Foreign Tax Credit for some other category income (In Amy’s situation, Passive Category Income). In the following pictures, we’ll show the computations of the Passive income.

Part II

Part II will look the same as with the previous form. The only difference will be the amount of taxes paid for this category of income.

Part III and Part IV of the form will reflect the computation of passive income. Including the ratio of passive income/standard deduction, which is significantly lower comparing to general income/standard deduction ratio. The portion of US taxes imposed on passive income will be allocated accordingly.

Since the foreign taxes paid on passive income has covered the entire portion of US taxes imposed on passive income, Part IV of the Form 1116 Foreign Tax Credit will be empty.

Since the Foreign taxes paid on General income were higher than the imposed tax on the 1040 tax return, an excess of the credit will be considered as the amount eligible for a carryover. About which we wrote earlier in this article. If necessary, that amount (US$ 4,354) can be utilized to offset the tax owing in the following tax year(s).

In Amy’s case, utilizing form 1116 Foreign Tax Credit over the Foreign Earned Income Exclusion is a better decision. Considering that the FEIE would cover only the first $120,000 of the earnings, while the passive income will be taxed regularly.

Frequently Asked Questions

1. Should I always use the FTC, or should I claim the foreign earned income exclusion (the FEIE)?

If you live and/or work abroad in a country whose foreign tax rate is higher that the U.S. federal tax rate, then it may be best for you to claim the Foreign Tax Credit (Form 1116). It’s much easier to claim the FTC than the FEIE, and you open yourself up to other tax breaks like the child tax credit by doing so.

2. Can I claim both the FTC and the FEIE?

You can! The main limitation to filing both the FTC and the Foreign Earned Income Exclusion (FEIE) is that you can’t claim a FTC on income you excluded from US tax with the FEIE. Check out our FAQ Section

If you have any questions or assistance with your filing, don’t hesitate to contact us. We’re here to help!