For many Americans, tax season starts with a familiar form: the W-2 Wage and Tax Statement. It shows your total wages, taxes withheld, and other important income information. But what if you’re a U.S. expat working for a foreign employer? If you’re living abroad, chances are you won’t receive a W-2 — and that’s perfectly normal.

Here’s what you need to know about how to file taxes without a W-2, and how to stay compliant with U.S. tax laws even when working overseas.

Why You Don’t Have a W-2 Abroad

The W-2 is an information return that U.S. employers are required to send to both the employee and the IRS to report total wages, taxes withheld, and other payroll details. But a foreign employer is not subject to U.S. tax laws — they follow the employment laws of their own country. That means they are not required to issue a W-2 or submit any tax statement to the IRS on your behalf.

If you’re working for a non-U.S. company, it’s completely normal not to receive a form W-2 — but you still have to file your taxes with the IRS.

Yes, You Still Need to File Your Taxes

U.S. citizens and Green Card holders must file a federal tax return every year, no matter where in the world they live or earn income. This includes reporting your foreign earned income, foreign interest, and any other tax information.

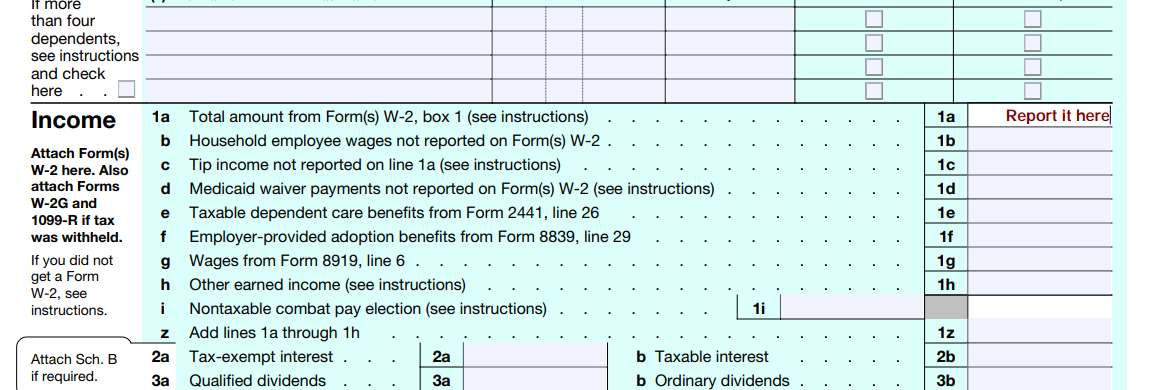

Even without a W-2, you can still file your taxes easily — you just have to report your income manually on the correct lines of your IRS form 1040.

What to Do If You Don’t Have a W-2?

Step 1: Gather Your Income Information

Even though you don’t have a W-2, you do have earnings. You’ll need to gather your final pay stub, foreign pay slips, employment contracts, or any documents that show your total wages and any taxes withheld by your foreign employer or country.

Pro tip: If your pay stubs are in another language or currency, make sure to convert the figures into U.S. dollars using the IRS’s acceptable currency conversion rates.

Step 2: Report Your Foreign Earned Income

You’ll report your foreign earned income on Form 1040, Line 1 (wages, salaries, tips, etc.). Even if you didn’t get a W-2, this line is where your income goes. You do not need to attach a W-2 if you don’t have one.

If you also have foreign interest, dividends, or capital gains, these need to be reported according to their classification — just like you would if they were earned in the U.S.

What About Form 4852?

IRS Form 4852 is used to substitute a missing W-2 or 1099-R when a U.S. employer fails to issue one. This form is not necessary for expats working for foreign employers. Since your foreign employer isn’t required to provide a W-2, there’s no “missing form” to replace.

You are not required to file Form 4852 just because you didn’t get a W-2 from a foreign employer.

Why Software Sometimes Gets Tricky Without a W-2

Tax software is often built around standard U.S. forms like the W-2 or 1099. If you don’t have these, it may feel confusing at first — but don’t worry. Most tax software still lets you manually input your income, and many have specific sections for foreign earned income and the Foreign Earned Income Exclusion (FEIE).

You may need to input:

- Your total foreign wages

- Any taxes paid to a foreign country

- Your foreign address

- Your employer’s address

What If You’re a U.S. Resident Missing a W-2?

If you’re living in the U.S. and expected to receive a W-2 from your employer but didn’t, that’s a different situation than U.S. expats. U.S. employers are legally required to send Wage and Tax Statements (W-2 forms) by January 31 each year. If yours is late, first contact your employer directly and request the missing form.

If you don’t get a response, you can call the IRS helpline at +1-800-829-1040 for assistance. If you still haven’t received your W-2 by the tax deadline, you can file your taxes using IRS Form 4852, which acts as a substitute W-2. You’ll need to estimate your wages and taxes withheld using your final pay stub or payroll records.

Need Help Filing Without a W-2? Contact Us

Filing your U.S. taxes as an expat — especially without a W-2 — can feel overwhelming, but it doesn’t have to be. We’re experts in U.S. expat tax filing, and we’re here to help.

Whether you need help understanding how to report your total wages, navigate the IRS website, or organize your tax information, we’ve got your back. We even offer free tax advice to all U.S. expats.

Contact us today and let us help you file with confidence this tax season — no W-2 required.