If you’re a U.S. citizen or Green Card holder living in the United Kingdom, you might be wondering about your tax obligations back home. Filing U.S. taxes from the UK can seem daunting, but it doesn’t have to be. The good news is that while you are required to file a tax return, you most likely won’t owe any U.S. taxes thanks to credits and exclusions designed to prevent double taxation. This guide will walk you through what you need to know to stay compliant without unnecessary stress.

Do I Have to File a US Tax Return If I Live in the UK?

Yes, you do. As a U.S. citizen or resident alien, you’re required to file a U.S. tax return every year once your income exceeds the filing threshold, no matter where you live. The United States taxes its citizens and residents on their worldwide income, which means income earned in the UK must be reported on your U.S. tax return.

Why Filing Is Necessary Even If You Owe Nothing

While it’s true that you may not owe any U.S. taxes due to provisions like the Foreign Earned Income Exclusion and the Foreign Tax Credit, you’re still obligated to file a return to claim these benefits. Failing to file can result in penalties and the loss of these valuable exclusions and credits.

What Are the Tax Filing Requirements for US Expats Living in the UK?

As a US expat residing in the UK, you are required to file a US tax return annually, reporting your worldwide income—even if all of it was earned outside the United States. Meeting these requirements involves several key aspects.

Income Thresholds: Income thresholds are crucial to determine if you need to file. US citizens and resident aliens must file if their income exceeds certain limits, which vary based on filing status and age. For example, single filers under 65 must file if they earn over $12,950 for the 2023 tax year. Self-employed individuals have a much lower threshold, needing to file if they have just $400 in net earnings.

Additional Forms: Expats often need to file additional forms. Form 2555 is used to claim the Foreign Earned Income Exclusion (FEIE), allowing you to exclude up to $120,000 of foreign earned income from US taxation. Another important form is Form 1116 for the Foreign Tax Credit (FTC), which offsets US tax liability with taxes paid to the UK.

Foreign Bank Account Reporting (FBAR): If the combined balance of your foreign financial accounts exceeds $10,000 at any time during the year, you are required to file a Foreign Bank Account Report (FBAR) using FinCEN Form 114.

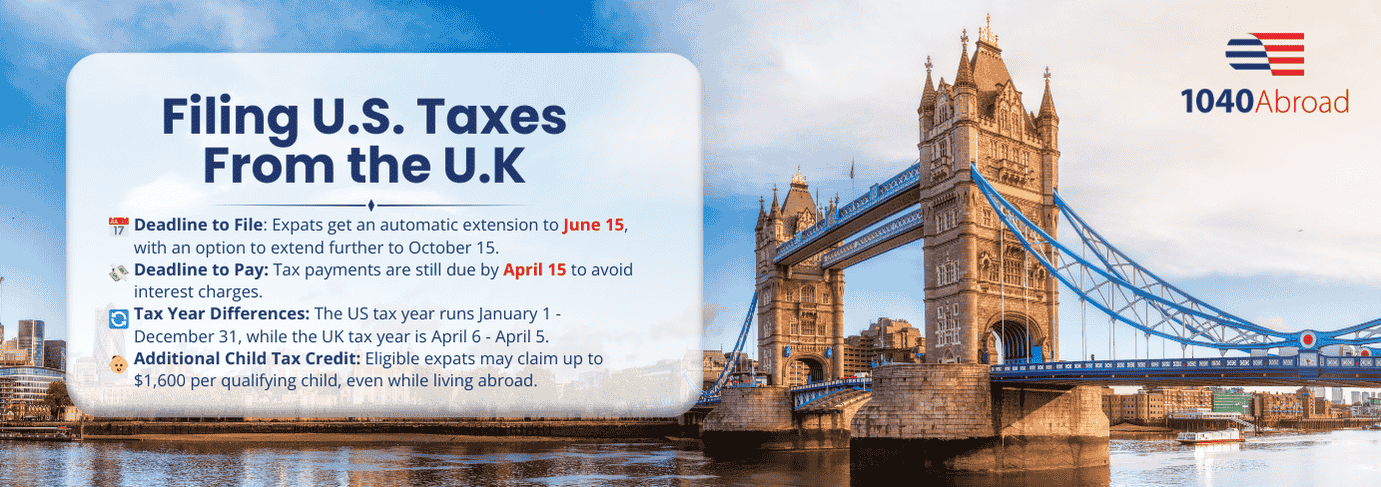

Filing Deadlines: Understanding filing deadlines is also essential. The standard deadline is April 15, but there is an automatic extension for expats to June 15. You can obtain an additional extension to October 15 by filing Form 4868.

Foreign Financial Asset Reporting: If you have specified foreign financial assets exceeding certain thresholds—for instance, $200,000 on the last day of the tax year for individuals living abroad—you may need to file Form 8938 to report them.

Social Security and Self-Employment Tax: Finally, if you’re self-employed, you may still owe US self-employment tax even if you don’t owe income tax. The Totalization Agreement between the US and UK may exempt you from double social security taxation.

By understanding and meeting these requirements, US expats in the UK can stay compliant, avoid penalties, and minimize their US tax liability through credits and exclusions.

How Do Different Tax Years in the US and UK Affect My Tax Return?

The U.S. tax year runs from January 1 to December 31, while the UK tax year runs from April 6 to April 5 of the following year. These differences require careful coordination when filing taxes.

Prorating Income

Since the tax years don’t align, U.S. citizens living in the UK must prorate their UK income to fit the U.S. calendar year. This involves converting UK earnings into U.S. dollars using exchange rates (such as specific date rates, monthly averages, or annual averages) depending on the reporting method chosen.

How Do I Report My UK Income on My US Tax Return?

To report UK income on your US tax return, you’ll need to document all income sources and convert your earnings into US dollars. Here’s a step-by-step guide to ensure compliance.

Step 1: Report Worldwide Income on Form 1040

As a US citizen or green card holder, you must report all global income, including UK wages, self-employment income, rental income, and any government benefits received in the UK. This is done on Form 1040, the standard US tax return form.

Step 2: Convert UK Income to USD

Convert your UK income into US dollars using IRS-approved exchange rates, either by transaction date for capital gains transactions or with the annual average rate. Accurate conversion is essential for aligning your UK earnings with US reporting requirements.

Step 3: Claim the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC)

To reduce your US tax liability, determine if you qualify for the Foreign Earned Income Exclusion (FEIE) and/or the Foreign Tax Credit (FTC). Filing Form 2555 allows eligible expats to exclude up to $120,000 of foreign-earned income (for 2023) from US taxation. Additionally, if you’ve paid income taxes in the UK, you can use Form 1116 to offset your US tax with the FTC, reducing double taxation on your income.

Step 4: Meet Additional Reporting Requirements

If your foreign financial accounts exceed $10,000 at any point during the year, you must file a Foreign Bank Account Report (FBAR) using FinCEN Form 114. Also, report any taxable UK government benefits as part of your US taxable income to ensure full compliance with US tax law.

By following these steps, you can meet US tax obligations and minimize double taxation on income earned in the UK.

Looking for Comprehensive Expat Tax Support?

At 1040 Abroad, we’re proud to be known as one of the most comprehensive expat tax services available. For a flat fee of $400, our services cover all the forms most US expats need to file, including the Foreign Tax Credit, Form 2555, and more. We also include a tax consultation call with one of our experienced accountants to address any questions you have along the way. Meet your dedicated accountant today and let us handle the complexities of your expat tax filing.

Is There an Income Tax Treaty Between the U.S. and the UK?

Yes, the U.S. and the UK have a comprehensive income tax treaty designed to prevent double taxation and fiscal evasion. The treaty outlines which country has the right to tax different types of income and provides mechanisms for tax relief.

Key Provisions of the U.S.-UK Tax Treaty

Article 1: General Scope and the Saving Clause

The saving clause in Paragraph 3 of Article 1 states:

“Notwithstanding any provision of this Convention except paragraph (4) of this Article, a Contracting State may tax its residents (as determined under Article 4) and its nationals as if this Convention had not come into effect.”

Explanation: This means that the U.S. retains the right to tax its citizens and residents as if the treaty didn’t exist. However, certain incomes can still be re-sourced under the treaty to allow for tax credits.

Article 2: Taxes Covered

- United States: Federal income taxes imposed by the Internal Revenue Code, excluding social security taxes and federal excise taxes.

- United Kingdom: Income tax, corporation tax, capital gains tax, and petroleum revenue tax.

Explanation: This article defines the specific taxes to which the treaty applies, ensuring clarity on both sides.

Article 4: Residence

This article helps determine an individual’s tax residency status. For U.S. citizens residing in the UK, you are still considered a U.S. resident for tax purposes. However, this article can help non-resident aliens determine their obligations.

Article 6: Income from Real Property

“Income derived by a resident of a Contracting State from real property situated in the other Contracting State may be taxed in that other State.”

Explanation: If you own property in the UK, the income from it can be taxed by the UK.

Article 7: Business Profits

“The business profits of an enterprise of a Contracting State shall be taxable only in that State unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein.”

Explanation: If you run a business in the UK, profits are generally taxed only in the UK unless you have a permanent establishment in the U.S.

Utilizing the Treaty to Avoid Double Taxation

While the saving clause limits some benefits, you can still utilize the treaty to:

- Re-source income to the UK for U.S. tax purposes.

- Claim the Foreign Tax Credit to offset U.S. tax liability with taxes paid to the UK.

How Do US Expats Living in the UK Minimize Their Tax Liability?

For US citizens and green card holders living in the UK, minimizing US tax liability while meeting obligations under both the US tax system and the UK tax system requires careful planning. Below are key strategies for expats to reduce taxable income and avoid double taxation:

- Utilize the US-UK Tax Treaty: The US-UK tax treaty provides a framework to prevent double taxation, allowing for relief on income taxes paid to both countries. Under this treaty, certain types of income may be taxed only in one country, while others, like social security benefits, may receive tax-free treatment or reduced tax rates.

- Claim Foreign Tax Credits: Foreign taxes paid in the UK can offset income tax owed in the US through the Foreign Tax Credit. By filing Form 1116 on your US tax return, you can reduce your federal tax liability by the amount of income tax you paid to the foreign country. This credit is especially helpful for those who pay higher UK tax rates on income taxes, capital gains tax, and dividend income.

- Foreign Earned Income Exclusion and Housing Exclusion: If you qualify, you can exclude a portion of your foreign earned income through the Foreign Earned Income Exclusion (FEIE) by filing Form 2555. For 2024, you can exclude up to $126,500 of foreign-earned income. Expats with foreign housing expenses may also benefit from the foreign housing exclusion, which allows further deductions from taxable income.

- Reporting Foreign Financial Accounts and Foreign Assets: Expats with foreign financial accounts (including foreign bank accounts, foreign assets, and personal pensions) exceeding $10,000 are required to file the Foreign Bank Account Report (FBAR). Reporting foreign financial accounts is essential to avoid penalties from the Internal Revenue Service (IRS). Additionally, certain foreign assets may need to be reported using Form 8938 as part of the federal tax return.

- Leverage Capital Gains Tax Planning: The US and the UK have different tax treatment for capital gains. If you’re subject to capital gains tax in both countries, the tax treaty can help determine which country has primary taxing rights, potentially reducing or eliminating your tax liability on capital gains.

- Handle Social Security Tax and National Insurance Contributions: The US-UK Totalization Agreement prevents dual taxation on social security taxes. Expats can choose to pay either US social security tax or national insurance contributions in the UK, depending on where they are primarily employed. This helps prevent paying taxes on the same income to both governments.

- Consult a Tax Advisor for Planning and Compliance: Proper tax planning is essential for expats, as complex tax requirements can lead to unpaid tax or tax withheld unnecessarily. A qualified tax advisor experienced in expat taxes can provide tax advice on everything from paper tax returns to reporting passive income, dividend income, unemployment benefits, and foreign housing expenses. This guidance ensures compliance and helps expats reduce overall tax burdens and at 1040 Abroad, we offer free tax advice to all US expats.

- Understand Tax Filing Requirements: Expats must file a federal tax return based on the calendar year, unlike the UK tax year that runs from April 6 to April 5. Ensuring accurate reporting of taxable income and meeting tax responsibilities on time helps avoid IRS penalties.

By applying these strategies and leveraging the US-UK tax treaty benefits, expats can better manage their US tax liability and effectively coordinate their obligations to both the US and UK tax systems.

Free Tax Advice

If navigating the US tax system from the UK feels overwhelming, 1040 Abroad is here to help. Our team specializes in comprehensive expat tax services and is ready to guide you through each step of filing your US tax return accurately, while ensuring you take full advantage of credits and exclusions.

Contact us today for a free tax consultation with an experienced tax advisor who understands the complexities of US expat taxes. Visit 1040abroad.com to learn more and take the stress out of your tax filing.