Our blog

Spreading the joy of information with you

Form 8854: The Final Step in Leaving U.S. Tax System

For US expats ready to renounce their citizenship, understanding the final legal and tax steps is essential. Form 8854, the Initial and...

IRS Form 8621: Understanding PFIC taxation

Navigating the complexities of US tax obligations can be a daunting task, especially for Americans living abroad. Among the myriad of...

The Substantial Presence Test: How to Calculate It with Examples

Navigating the complex landscape of U.S. tax regulations can be a daunting task, especially for individuals who split their time between...

Grab Your Unclaimed Stimulus Checks: Last Chance for Late Tax Filers!

As a US expat, you're accustomed to navigating the complexities of living abroad. But there's one opportunity you don't want to miss –...

US Expat Tax News for 2024

As the year 2024 approaches, individuals and businesses need to be aware of the upcoming tax changes that will impact their financial...

Stimulus Checks: Why 2024 is the Year to Get Tax Compliant

If you're one of the many Americans who has fallen behind on your taxes, now is the perfect time to get caught up and potentially receive...

Don’t Miss Out: A Guide to Recovery Rebate Credit for U.S. Expats

If you’re one of the many U.S. expats who are owed stimulus money, you can still claim it through Recovery Rebate Credit. As the matter of...

Tax Loss Harvesting and Cryptocurrencies

What is Tax Loss Harvesting? And how does it relate to Cryptocurrencies? Tax Loss Harvesting is a system used to offset your capital gains...

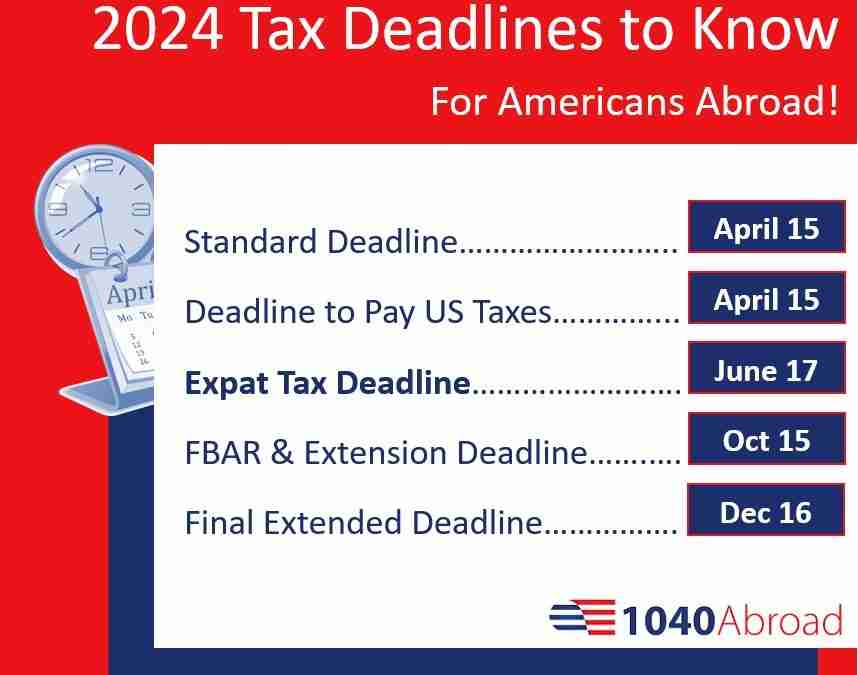

U.S. Expat Tax Deadlines for 2024: What You Need To Know

As we approach the 2024 tax season, you must be mindful of US tax filing deadlines to organize yourself and avoid unnecessary penalties...

2024 Federal Tax Income Brackets

As US expats prepare to navigate the complexities of the federal government's tax system for the 2023 tax year, understanding the updated...

How Many Years Back Do You Need to File FBAR?

As a U.S. expat, it’s essential to report your foreign income, and it’s easy to overlook the reporting obligation to file the FBAR, which...

The Complete Guide for Submitting Form 14653 for the Streamlined Program

As a U.S. expat, understanding your tax obligations is essential. Form 14653 plays a key role for those considering the IRS Streamlined...

How to File an Extension to December 15

Tax season is a stressful time for many, but it can be especially daunting for U.S. expats living abroad. Navigating the complexities of...

Form 3520-A Explained: The Ultimate Resource for US Expats

Navigating the complexities of U.S. tax compliance and international taxation can be challenging, especially for U.S. expatriates. One...