Our blog

Spreading the joy of information with you

Avoiding Delays: A Guide to ITIN Renewal for Taxpayers

An Individual Taxpayer Identification Number (ITIN) is a unique identification number assigned by the Internal Revenue Service (IRS) to...

IRS Amnesty Programs for Accidental Americans and other late filers

It doesn't come as a surprise that the IRS will be filling the budget hole in 2023 by cracking down on non-compliant U.S. citizens living...

Relief Procedures for Certain Former Citizens

The IRS released a new program that allows former U.S. citizens to become compliant with the U.S. tax law without risking any penalties -...

U.S. Expat Tax Deadlines for 2023: What You Need To Know

With so much going on in our lives, it’s easy to get distracted and forget to pay attention to important things - like filing taxes on...

Renouncing U.S. citizenship in Azerbaijan

Hello. My name is Olivier Wagner. I've been preparing tax returns for American living overseas since 2012...

5 Myths about renouncing US citizenship

Welcome, welcome!!! I'm Olivier Wagner, and today I’ll discuss five myths surrounding renouncing U.S. citizenship. Those were urban...

Guide to US Gift and Estate Tax for US Expats

Are you worried about paying inheritance/estate/gift tax in the United States and your country of residence? In this guide, we'll discuss...

The IRS received $80 billion and it fueled fear tactics among accounting firms

The Biden administration is granting the IRS an extra $80 billion under the newly passed Inflation Reduction Act I have seen some of my...

Automatic abatement of late filing penalties under Notice 2022-36

Good afternoon this is Olivier Wagner with 1040 Abroad here to discuss the basics of a recent notice that was published by the internal...

IRS Offers Automatic Late Filing Penalty Relief: 2019 and 2020 Returns

The IRS announced that it would automatically waive specific penalties for failure to file (late filing penalty) for tax returns and...

Notice 2022-36: Automatic relief procedure: What does it cover and what does it mean for taxpayers with international assets?

Today, the IRS issued Notice 2022-36, which will abate the late filing penalties for many tax returns and forms as they relate to tax...

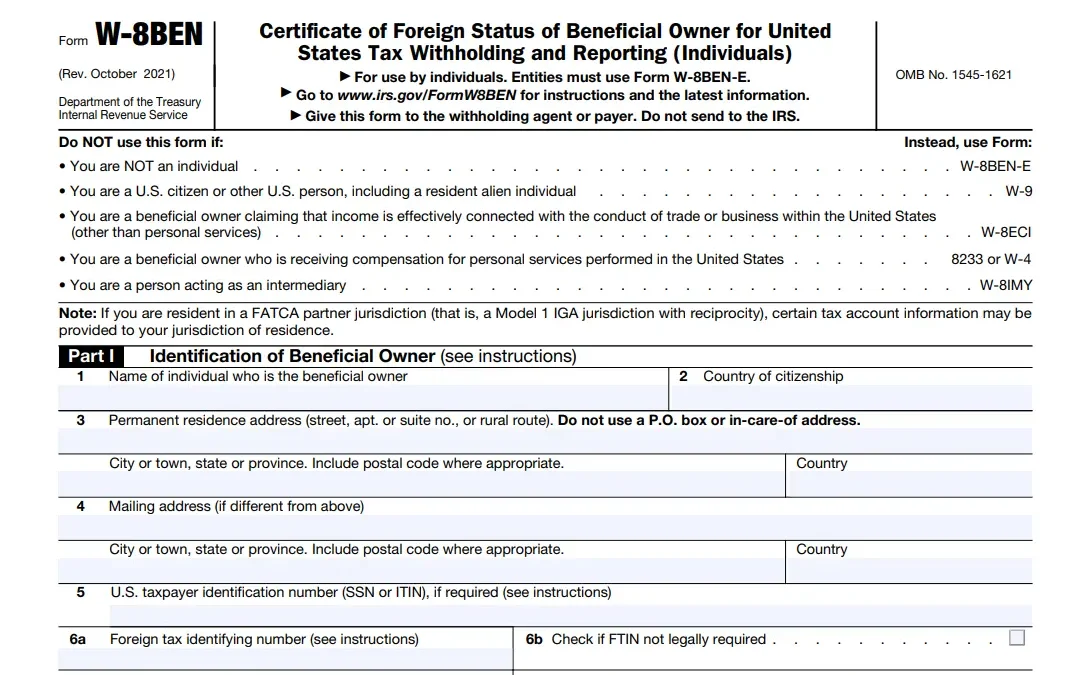

What is Form W-8BEN, and why is it so important?

Form W-8 BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)) is a...

Cryptocurrency and NFT taxation for U.S. Expats

The United States Internal Revenue Service (IRS) does not recognize cryptocurrency as currency for federal income tax reporting purposes....

Dormant foreign companies are not subject to the complex filing requirements of Form 5471

The reporting requirements for IRS Form 5471 are complex, including "categories of documents" and required timeframes. However, few...