If you’re a U.S. citizen or Green Card holder living in Germany, navigating tax obligations under both U.S. and German tax systems is essential. The tax landscape for expats can be complex, with unique residency rules, different income tax rates, and considerations around double taxation. This guide aims to clarify these issues, providing U.S. expats with everything they need to know about filing U.S. and German taxes while minimizing their tax liability.

How Much Tax Do Expats Pay in Germany?

As a U.S. expat in Germany, you’re likely subject to German income tax, which follows a progressive rate system ranging from 0% to 45%. Additional charges, such as social security contributions, a solidarity surcharge, and, in some cases, church tax, also affect your total tax obligation.

Progressive Income Tax Rates: Income tax rates in Germany vary based on your income level. For lower income, the rate is close to 0%, but it can increase to 45% for higher earnings. Here’s a quick look:

| Taxable Income in EUR | Tax rate |

|---|---|

| Less than €10,908 | 0 |

| €10,909 – €62,809 | 14-42% |

| €62,810 – €277,825 | 42% |

| More than €277,826 | 45% |

This progressive rate system makes it important for expats to understand their income bracket, which, along with their specific income types, determines the total amount of tax owed. Keep in mind that social security contributions and other taxes may further affect your tax liability.

What Are the Rules for Tax Residency in Germany?

Germany considers you a tax resident if you have a home in Germany (domicile) or if you spend more than 183 days in the country within a tax year.

Implications of Tax Residency:

- Tax Residents: If you’re a tax resident in Germany, you are subject to German tax on your worldwide income, meaning that income earned in the U.S. and other countries is also taxed in Germany.

- Non-Tax Residents: As a non-tax resident, only income generated within Germany is subject to German taxation.

Being clear about your residency status helps prevent unexpected tax obligations and ensures compliance with both German and U.S. tax laws.

Are Income Tax Rates Higher in Germany or the USA?

Generally, income tax rates are higher in Germany, especially for middle to high-income earners. The German tax system’s progressive nature means that as income increases, the tax rate also rises, reaching as high as 45% for high earners. Here’s a comparison:

- U.S. Federal Tax Rate: The highest rate is 37%.

- German Income Tax Rate: The top rate is 45%, with additional charges like the solidarity surcharge and church tax.

Because Germany’s top income tax rate is higher, U.S. expats with higher earnings in Germany may face a larger tax burden than they would in the U.S. However, the foreign tax credit often offsets U.S. tax liability, helping avoid double taxation on income earned in Germany.

What Additional Taxes Do US Expats Face in Germany?

In addition to income tax, US expats and Geen Card holders may encounter several other taxes while living in Germany, depending on their financial activities and lifestyle:

- Value-Added Tax (VAT): VAT is a tax on goods and services and is set at 19% in Germany, with a reduced rate of 7% for certain essential goods and services. It’s particularly relevant for self-employed individuals and businesses.

- Real Estate Transfer Tax: When acquiring real estate in Germany, a real estate transfer tax applies, varying between 3.5% and 6.5% depending on the federal state.

- Inheritance and Gift Tax: Germany imposes taxes on inheritances and gifts, with rates and exemptions varying based on the relationship between the giver and recipient.

- Church Tax: This tax is unique to Germany and applies to individuals who belong to certain religious organizations. Rates vary but are generally 8-9% of your income tax liability.

- Dog Tax: Pet owners in Germany who own dogs are subject to a dog tax, which varies based on the municipality. Expats should be aware that this tax applies only to dogs.

Understanding these various tax obligations is essential for expats who wish to remain compliant with German tax authorities and avoid potential penalties.

How to File Tax Returns in Germany?

Filing tax returns in Germany involves understanding your obligations based on your income sources and residency status. Whether you’re an employee, self-employed, or have other income streams, knowing the filing process can help you stay compliant and potentially benefit from tax refunds.

Who Must File a Tax Return?

In Germany, not everyone is required to file a tax return, but it’s mandatory under certain conditions. You must file if:

- You have secondary income exceeding €410.

- You earn rental income over €410.

- You receive freelance income.

- You have capital gains subject to withholding tax without prior dividend tax paid.

- You received wage replacement benefits exceeding €410, such as unemployment benefits.

- You had multiple overlapping work contracts.

- You’ve been notified by the tax office (Finanzamt) of a filing obligation.

Even if you’re not required to file, submitting a tax return voluntarily can be advantageous. Many employees who file voluntarily receive an average refund of about €1,063, making it worthwhile to consider.

The Filing Process

- Determine Your Tax Filing Status: Identify whether you’re employed, self-employed, or have other sources of income. Your tax obligations may vary depending on your status.

- Gather Necessary Documentation: Collect all relevant documents, such as your annual payslip from your employment income (Lohnsteuerbescheinigung), receipts for deductible expenses, and records of any additional income.

- Complete the Tax Return Forms: Use the official forms provided by the Finanzamt. The primary form is the Einkommensteuererklärung (income tax return). Depending on your situation, you may need to fill out additional attachments for different types of income or deductions.

- Submit Your Return: You can file your tax return electronically through the ELSTER portal (the official online tax system in Germany) or by sending paper forms to your local Finanzamt. Electronic filing is generally faster and more efficient.

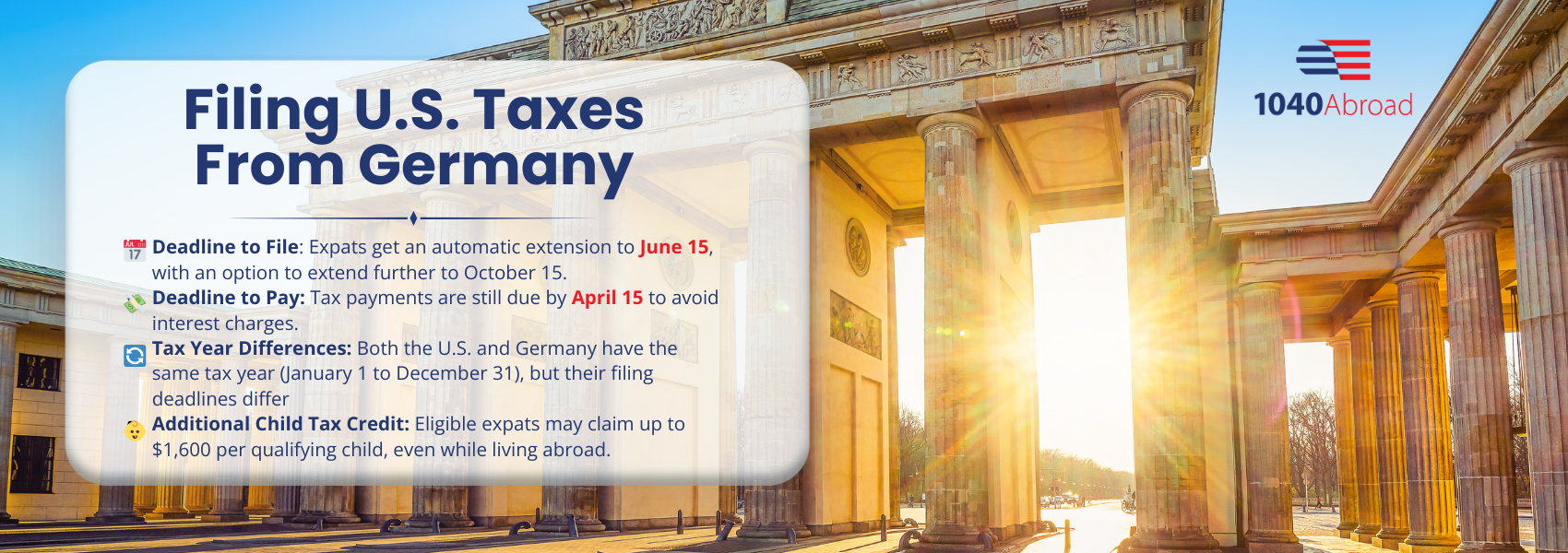

German Tax Deadlines

For mandatory filings, the deadline is July 31 of the year following the tax year. If you’re using a tax advisor, the deadline extends to December 31 of the following year. For voluntary filings, you have up to four years to submit your return retroactively, which can be beneficial if you’re expecting a refund.

Capital Gains Tax and Investment Income in Germany

In addition to income tax on employment income, U.S. expats should be mindful of capital gains tax on investment income in Germany. Under German income tax law, capital gains derived from the sale of assets like stocks and bonds are generally subject to a flat tax rate of 25%, known as the Abgeltungsteuer, plus the solidarity surcharge tax and, if applicable, church tax. This brings the total tax on investment income to approximately 26.375%. However, there is a basic tax-free allowance (Sparer-Pauschbetrag) of €801 for single taxpayers and €1,602 for married taxpayers filing jointly, allowing you to earn some investment income tax-free. Understanding how capital gains are taxed can help you manage your overall tax liability and plan your investments accordingly.

Which US Tax Forms Do I Need to File as an Expat in Germany?

As a U.S. citizen or Green Card holder living in Germany, you’re required to file several essential tax forms with the IRS to ensure compliance and avoid penalties.

Filing Your Primary Income Form: Form 1040

You must file Form 1040, the U.S. Individual Income Tax Return, which reports all worldwide income, including any employment income or investment income you may have in Germany. This is your primary income tax return for U.S. expats in Germany, essential for ensuring compliance with U.S. tax law.

Foreign Bank Account Reporting: FBAR (FinCEN Form 114)

If you hold combined financial accounts exceeding $10,000 at any time during the tax year, you’re required to file the Foreign Bank Account Report (FBAR) using FinCEN Form 114, submitted electronically. FBAR requirements apply to German bank accounts and other foreign financial accounts, making this an essential step for U.S. expats with financial assets abroad.

Reporting Foreign Assets: Form 8938 (Statement of Specified Foreign Financial Assets)

If you hold significant foreign assets—specifically, if your assets exceed $200,000 on the last day of the tax year or $300,000 at any time during the year—you must file Form 8938, the Statement of Specified Foreign Financial Assets. This form details various asset types, including foreign bank accounts and foreign investment income, to meet IRS reporting requirements for expats.

Claiming the Foreign Tax Credit: Form 1116

To mitigate double taxation, U.S. expats in Germany can file Form 1116, the Foreign Tax Credit. This form allows you to claim a credit for taxes paid to Germany, which can offset U.S. tax liability on the same income. The Foreign Tax Credit is crucial for U.S. taxpayers in Germany, helping to reduce overall tax burdens under both U.S. and German income tax systems.

Excluding Foreign Earned Income: Form 2555

Expats who qualify may file Form 2555, the Foreign Earned Income Exclusion (FEIE), allowing them to exclude up to $120,000 (for 2023) of foreign-earned income from their U.S. taxable income. This exclusion is especially beneficial for U.S. expats whose primary income source is from German employment, as it reduces taxable income and, in turn, U.S. tax obligations.

Looking for Expert Tax Assistance? At 1040 Abroad, we specialize in providing comprehensive tax services for US expats. Contact us for a free consultation and let our team of experts help you with your US tax filing needs, ensuring compliance and peace of mind.

Is there a Tax Treaty between the U.S. and Germany?

Yes, the U.S.-Germany tax treaty is designed to prevent double taxation and foster economic cooperation between the two countries by clarifying tax obligations for U.S. citizens living in Germany. The treaty allows U.S. expats to claim a foreign tax credit on their U.S. tax return for taxes paid to Germany, reducing the risk of being taxed twice on the same income.

Key provisions include guidelines for determining tax residency and rules for taxation of various types of income, such as dividends, interest, and royalties. For example, dividends paid to U.S. residents by German companies are capped at a reduced withholding rate, typically no more than 15%.

Additionally, the treaty provides that pension income is generally taxed only in the country where the recipient resides. A critical component, known as the “savings clause,” requires U.S. citizens to continue reporting their worldwide income to the IRS, even if they are tax residents in Germany. The treaty also facilitates the exchange of tax information between the U.S. and Germany, which helps both countries ensure compliance and prevents tax evasion. For U.S. expats, understanding these treaty provisions is essential for managing tax obligations effectively and minimizing tax liabilities in both countries.

How Can US Expats Minimize Their Tax Liability?

US expats in Germany have access to several tax relief options to help reduce or eliminate double taxation:

- Foreign Earned Income Exclusion (FEIE): If you qualify, the FEIE allows you to exclude up to $120,000 (for 2023) of foreign-earned income from US taxation by filing Form 2555. This exclusion is especially beneficial for US expats with income solely earned in Germany.

- Foreign Tax Credit (FTC): By filing Form 1116, you can claim a credit for taxes paid to Germany, reducing your US tax liability on foreign income. The FTC is a dollar-for-dollar credit, making it a highly effective way to offset US tax liability for US expats paying higher taxes in Germany.

- Foreign Housing Exclusion/Deduction: For expats with high housing costs, the Foreign Housing Exclusion allows eligible taxpayers to exclude or deduct some housing expenses from their US taxable income. This exclusion applies to rent and other housing costs and is particularly helpful for expats living in high-cost cities like Berlin or Munich.

What are the tax incentives for expats in Germany?

Germany offers various incentives and deductions for expats, which can help reduce their tax burden. Some common tax incentives include:

- Child Tax Benefits: US expats with children may qualify for the US Additional Child Tax Credit, which provides up to $1,600 per qualifying child. Germany also offers child benefits (Kindergeld), which provide additional financial support to families.

- Business Deductions: Self-employed expats can claim various business expenses, including office supplies, travel costs, and even home office deductions, to reduce their taxable income in Germany.

- Relocation Expenses: Moving to Germany for work purposes may make you eligible for certain deductions on relocation expenses, provided they meet the requirements under German tax law.

What if I never filed US expat taxes as an American living in Germany?

Don’t panic, this case is a lot more common than you might think. If you are behind your US taxes, there is an official IRS tax amnesty program. It is called Streamlined Foreign Offshore Procedures. You can take advantage of it if you qualify based on the following requirements:

- Non-residency requirement: You must not have a US abode meaning you have lived 330 days in at least one of the last three tax years outside of the United States

- Non-compliance requirement: You have failed to file one or more tax returns and/or haven’t reported income from a foreign financial asset (FBAR, FinCEN form 114)

- Non-willful conduct: You failed to comply with U.S. tax returns unintentionally and weren’t aware of tax obligations to file and pay taxes, disclose your foreign financial assets, income etc.

Do you need a help with US expat taxes as an American living in Germany? Do not hesitate to contact us. We offer free tax advice to all US expats.